Introduction

Since 2008, much has changed in regard to how the Fed manages monetary policy/interest rates. We might even say “what a long, strange trip it’s been.” Moving into 2025 with the Trump administration, I think that phrase will still hold!

In 2015, I wrote an article titled “The Federal Reserve Tools: Past and Present” (https://www.gfmi.com/articles/the-federal-reserve-tools-past-and-present/) and updated it in the 2021 article titled “The Federal Reserve Tools to Manage Monetary Policy (https://www.gfmi.com/articles/the-federal-reserves-tools-to-manage-monetary-policy/).

It is now time to update the 2021 article. Specifically, this article will review the Fed’s current tools, including:

- Fed funds

- Ample reserve policy and administered rates

- Reserve requirements

- Interest paid on reserves (IORB)

- Overnight reverse repurchase agreements

- Quantitative easing/large asset purchases and quantitative tightening

- Open market operations

- Standing overnight repurchase agreement facility

- Discount window

- Transparency

But first let’s start with the Federal Reserve’s congressionally mandated goals.

The Federal Reserve Mandates

The Federal Reserve has two mandates: full employment and price stability. The latter is code for keeping inflation under control. The Fed’s current long range inflation goal is 2%.1 Defining full employment is more challenging. In a speech given in February 2021, Fed governor Lael Brainard stated:

“The new framework calls for monetary policy to seek to eliminate shortfalls of employment from its maximum level, in contrast to the previous approach that called for policy to minimize deviations when employment is too high as well as too low. The new framework also defines the maximum level of employment as a broad-based and inclusive goal assessed through a wide range of indicators.”

The new framework being referred to was a comprehensive and public review of monetary policy. Bottom line: There is plenty of room for interpretation.

Federal Funds/Fed Funds

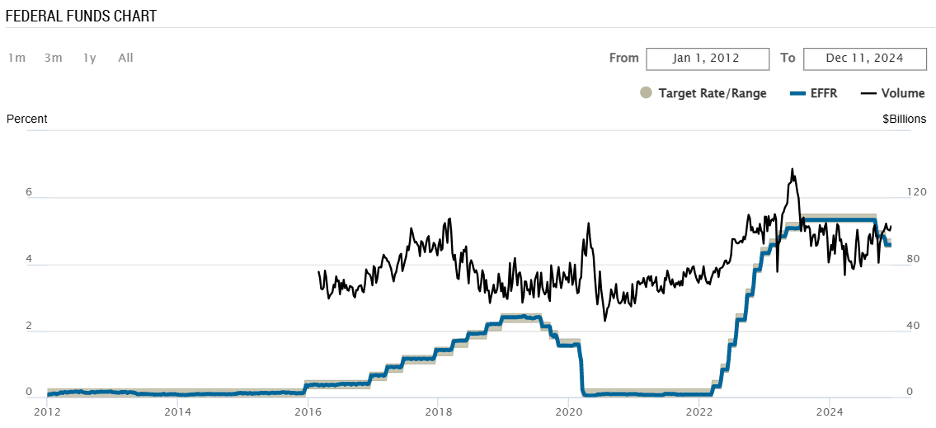

The Fed uses overnight fed funds as their main policy tool in managing interest rates. Specifically, they aim for a neutral fed funds rate that “…keeps the economy on an even keel when employment and inflation are close to their objectives.”3 The current target rate/range is 4.50-4.75%. The following chart shows the historical range, the EFFR and the volume of fed funds.

According to the Fed’s website, “The federal funds market consists of domestic unsecured borrowings in U.S. dollars by depository institutions from other depository institutions and certain other entities, primarily government-sponsored enterprises.”4 I always refer to it simply as “fed funds.” The final tabulated rate for each day is the Effective Fed Funds Rate, or EFFR. The vast majority of transactions mature overnight. Again, citing the Fed’s website, “The effective federal funds rate (EFFR) is calculated as a volume-weighted median of overnight federal funds transactions.”4 The Government Sponsored Enterprises, or GSEs, referred to above are dominated by the Federal Home Loan Banks, which are the main lenders in this market.

The following table depicts these rates going back to the Fed’s last meeting when they lowered the target rate for fed funds on November 8, 2024:

Ample Reserve Policy and Administered Rates

The Fed implements monetary policy through what is called an Ample Reserve policy. “The Committee (FOMC) intends to continue to implement monetary policy in a regime in which an ample supply of reserves ensures that control over the level of the federal funds rate and other short-term interest rates is exercised primarily through the setting of the Federal Reserve’s administered rates, and in which active management of the supply of reserves is not required”. The ample reserve policy is also known as a floor policy, which is described later.

Based on the above, let’s discuss reserve requirements and administered rates.

Reserve Requirements and Interest on Reserve Balances (IORB)

Effective March 26, 2020, the Federal Reserve eliminated reserve requirements for all depository institutions.5Specifically, the reserve requirements were set to zero. By doing this, the Fed can reimpose reserve requirements if they deem it necessary.

Prior to 2008, the Fed did not pay interest on reserves. As a result of a 2008 act of Congress, the Fed was permitted to pay interest on reserves, and started doing so on reserve accounts as of October 1, 2008.6

Since the Fed still had reserve requirements, they broke down the interest between interest on required reserves (IORR) and interest on excess reserves (IOER). Effective July 28, 2021, the Fed eliminated IORR and IOER which leaves us with IORB. Don’t you love acronyms?

Since November 8, 2024, IORB is 4.65%.

You may be wondering if there are no reserve requirements, why would banks leave money with the Fed? The answer is twofold. First, banks have day to day liquidity needs as well as longer-term liquidity requirements. The banks’ accounts with the Fed act in a similar nature to a personal checking account whereby both payments and receipts are received in this account. Second, banks have a choice between lending in the fed funds market or leaving cash with the Fed. As can be seen above, the IORB is higher than the fed funds rate leaving this choice as a no brainer.

Overnight Reverse Repurchase Agreements Facility (RRP)

Overnight reverse repurchase agreements/reverse repos helps keep a floor under the fed funds rate. In this transaction, the Fed sells a security to a counterparty, and the counterparty simultaneously lends cash to the Fed. The Fed pays interest on the use of the cash. The transaction is reversed the next day. While the transaction is outstanding, the cash is on the Fed’s balance sheet, which resides outside of the financial system. Therefore, the cash cannot be used by banks or other financial institutions in the financial system. The thought process is that the counterparty would not lend to another counterparty at a lower rate than the RRP. This thought process is similar to the IORB. The counterparties consist of banks, government sponsored enterprises, and money market funds. A list of the counterparties can be found at: https://www.newyorkfed.org/markets/rrp_counterparties.html

The current overnight reverse repo rate is 4.55% which is slightly lower than the IORB. But also note that it puts a floor under the fed funds rate, hence the term floor policy. Technically, the RRP is set by an auction and the highest the Fed would currently pay is 4.55%.

Large Asset Purchases/Quantitative Easing and Quantitative Tightening

Owing to the Credit Crisis, the Federal Reserve turned to large asset purchases, commonly called quantitative easing (QE), which played a crucial role in keeping interest rates low. During QE, the Fed purchased both U.S. government notes/bonds and agency notes and mortgage-backed securities (MBS). This, in turn, kept interest rates low during periods of QE. Keeping interest rates low, in theory, help the Fed achieve their dual mandate.

During Quantitative Tightening (QT), the Fed can sell securities they currently own or not roll over what securities they currently own at maturity. They have chosen the latter. Specifically, they do not roll over UST and agency MBS up to a certain cap. The current domestic policy directive from their November 2024 meeting is shown below:

- Roll over at auction the amount of principal payments from the Federal Reserve’s holdings of Treasury securities maturing in each calendar month that exceeds a cap of $25 billion per month. Redeem Treasury coupon securities up to this monthly cap and Treasury bills to the extent that coupon principal payments are less than the monthly cap.

- Reinvest the amount of principal payments from the Federal Reserve’s holdings of agency debt and agency mortgage-backed securities (MBS) received in each calendar month that exceeds a cap of $35 billion per month into Treasury securities to roughly match the maturity composition of Treasury securities outstanding.7

The interesting point here is the Fed is no longer rolling over any agency debt or agency MBS but purchasing U.S. Treasuries that are above the respective cap.

The Fed announces their guidance on upcoming purchases during their Federal Open Market Committee (FOMC) meetings8. The following chart shows the Fed’s balance sheet over time starting right before the credit crisis:

Open Market Operations: Repos and Reverse Repos

Another tool the Fed uses to manage the fed funds target are repurchase agreements or, simply, repos and reverse repurchase agreements. (To better understand how repos work please go to https://www.gfmi.com/articles/libor-schmibor-whats-next-sofr-part/).

Repos come under the Fed’s heading of open market operations. In a repo transaction, the Fed lends cash to a counterparty, traditionally a primary dealer9, and receives collateral, which is usually a U.S. Treasury. The transaction is reversed the next day and the borrower of the cash pays interest upon the maturity. The act of lending cash creates or adds money temporarily in the financial system. The Fed will execute this transaction to help stabilize the fed funds rate or, in extreme cases, help to bring it within its target range. For example, if fed funds are above the target range, the Fed will use repos to bring down the rate.

A reverse repo (from a transactional viewpoint, there is no difference between this reverse repo and the one mentioned above, except this is not a standing facility but used by the Fed when required) achieves the opposite goal and removes money temporarily from the financial system. In a reverse repo, the Fed borrows money and delivers collateral to the counterparty. At a later date, most often the next day, the transaction is reversed. In this case, the Fed pays interest for the use of funds. Similar to repos the Fed will execute this transaction to help stabilize the fed funds rate or in extreme cases, help to bring it into its target range. And, if fed funds have fallen below the target range, the Fed will use reverse repos to bring up the rate.

To be clear, most of these transactions have an overnight maturity.

Standing Overnight Repurchase Agreement Facility (SRF)

On July 28, 2021, the Fed instituted a standing repo facility. This is a form of repo transaction but has daily parameters. For example, as of November 8, 2024, the total operation is set at $500 billion and a minimum bid rate of 4.75%. It is a standing facility because it can be used by counterparties on any date. This is opposed to traditional repos which the Fed initiates during open market operations. The Fed “established the SRF to serve as a backstop in money markets to support the effective implementation and transmission of monetary policy and smooth market functioning.”10

The Discount Window and Discount Rate

Depository institutions may borrow money from the Fed on any given business day. The Fed lends money via their lending facility known as the discount window11 to depository institutions at the discount rate. Each borrowing is secured by collateral. The maturity may be up to 90 days and continuously renewed.

There are three interest rates associated with the discount rate. The Fed has various requirements to borrow at the primary credit rate (these are not discussed here but can be found at https://www.frbdiscountwindow.org/).

The Primary Credit Rate is set at the top of the range for fed funds which is currently 4.75%. Interestingly, the Fed only recently (in March 2020) made the change to have the primary rate reflect the general level of interest rates. Generally speaking, it has been higher than fed funds. In their March 15, 2020, news release, the Fed stated:

“Narrowing the spread of the primary credit rate relative to the general level of overnight interest rates should help encourage more active use of the window by depository institutions to meet unexpected funding needs.”12

The Secondary Credit Rate is usually 50 bps higher than the primary rate and as is currently 5.25%.

Seasonal Credit Rate is an option for smaller institution to manage seasonal flows and is currently 4.65%.

Historically, market participants viewed borrowing from the Fed as a last resort. It implies that firms borrowing from the Fed cannot borrow money in the open market, that is, they are having liquidity problems.

According to the Fed’s website:

“By providing ready access to funding, the discount window helps depository institutions manage their liquidity risks efficiently and avoid actions that have negative consequences for their customers, such as withdrawing credit during times of market stress. Thus, the discount window supports the smooth flow of credit to households and businesses.”13

As a side note, when reference is made to the “discount rate,” it generally refers to the primary credit rate.

Transparency/Forward Guidance

Historically, the Fed was not known for communicating or guiding market participants on their intentions for monetary policy. According to Nelson:

“Forward guidance—the issuance by a central bank of public statements concerning the likely future settings of its policy instruments—is now a key aspect of monetary policy in the United States…, limited moves toward the inclusion of forward guidance in the Federal Open Market Committee’s (FOMC) post meeting policy statements occurred in 2003 and 2004. The regular incorporation of forward guidance into FOMC post meeting statements began in 2008.”14

Starting in 2015, the Fed started to include an implementation note along with the FOMC statement: “The implementation note provides important details about how the Federal Reserve’s policy tools are being used to keep the federal funds rate in the target range established by the FOMC. This information should help increase public awareness and understanding about the normalization of monetary policy.”15

Conclusion

Certainly, the Fed has many tools at their disposal to influence interest rates. As a result, market participants spend a lot of time and energy interpreting the impact on the financial markets. While the tools we have discussed are not the only ones the Fed uses, they are, in my opinion, the main tools that the market follows.

With the Trump administration starting in 2025, and the promise of tax cuts, tariffs, and less regulation, the Fed will, in all likelihood, be using all the tools at their disposal!

References

1 See https://www.federalreserve.gov/newsevents/pressreleases/monetary20200827a.htm

2 See https://www.federalreserve.gov/newsevents/speech/brainard20210224a.htm

3 See https://www.federalreserve.gov/monetarypolicy/review-of-monetary-policy-strategy-tools-and-communications.htm

4 See https://www.newyorkfed.org/markets/reference-rates/effr

5 See https://www.federalreserve.gov/monetarypolicy/reservereq.htm

6 See https://www.federalreserve.gov/monetarypolicy/reserve-balances.htm

7 See https://www.federalreserve.gov/monetarypolicy/files/monetary20241107a1.pdf

8 To have a more in depth understanding of the Fed’s normalization policy go to: https://www.federalreserve.gov/monetarypolicy/policy-normalization.htm

9 To understand the various counterparties with whom the Federal transacts, go to https://www.newyorkfed.org/markets/counterparties

10 See https://www.newyorkfed.org/markets/repo-agreement-ops-faq

11 According to Wikipedia, the term discount window “…originated with the practice of sending a bank representative to a reserve bank teller window when a bank needed to borrow money.” https://en.wikipedia.org/wiki/Discount_window

12 See https://www.federalreserve.gov/newsevents/pressreleases/monetary20200315b.htm

13 See https://www.federalreserve.gov/monetarypolicy/discountrate.htm

14 See https://www.federalreserve.gov/econres/feds/files/2021033pap.pdf

15 See https://www.federalreserve.gov/faqs/new-implementation-note-and-how-does-it-differ-from-the-fomc-postmeeting-statement.htm

About the Author: Ken Kapner

Prior to starting GFMI in 1998, Ken spent 14 years with the HSBC (Hong Kong and Shanghai Banking Corporation) Group in their Treasury and Capital markets area where he traded a variety of instruments including interest rate derivatives, spot and forward foreign exchange, money markets; managed the balance sheet; sat on the Asset Liability Committee; and was responsible for the overall Treasury activities of the bank. He later headed up HSBC’s Global Treasury and Capital Markets Product training for two years in Hong Kong. Specifically, his responsibilities included developing new courses and delivering courses to traders, support staff and relationship managers. In New York, he established a training department for the firms’ Securities Division where he was in charge of the MBA Associates Program, continuing education and Section 20 license.

He has co-authored/co-edited seven books on derivatives including The Swaps Handbook and Understanding Swaps.

Download article