Introduction

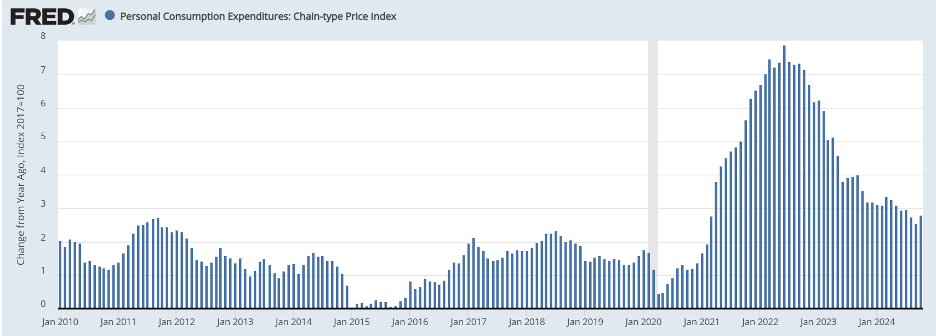

Tariffs have certainly dominated the economic news cycle of late. The foregone conclusion by pundits is that they will raise prices for consumers. However, we are currently in a disinflationary environment regardless of what inflation index you look at. Having said that, inflation seems to have bottomed out in the 2.50% neighborhood. The following chart is the personal consumption expenditure (PCE) index that is favored by the Federal Reserve:

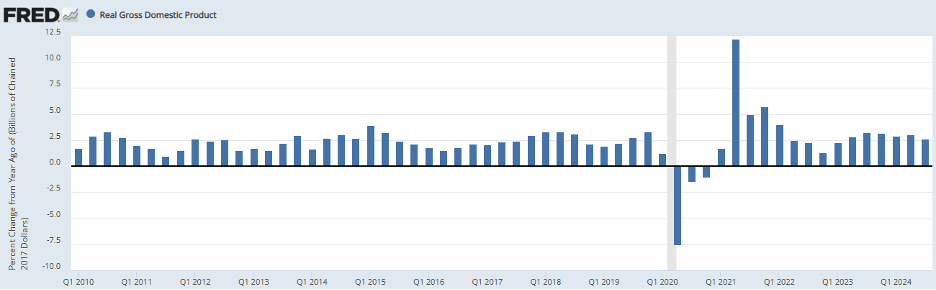

Clearly, the prices are on a downward trend. The question is, how will tariffs impact inflation? What about the movement to onshore production? Will tariffs impact economic growth, the U.S. dollar and the budget deficit? And here is a wild card: If U.S. foreign policy follows an isolationist/America first policy, how will the pulling back of American armed forces impact trade, and therefore inflation and GDP?Speaking of GDP, the following chart depicts the recent moderate growth:

It seems the new Trump administration will be starting off with moderate growth and inflation in a downward trend although bottoming out.To anchor our discussion, let’s start off with a quick definition of tariffs, their uses and history, the products they may impact, and discuss the other variables previously mentioned. As we will see, these interacting forces will make forecasting inflation, GDP, and other economic indicators a very challenging and dynamic undertaking.

Tariffs and Onshoring vs. Offshoring

Tariffs are a tax, also referred to as duties. (For all of the Seinfeld aficionados reading this, you may recall George and Kramer’s song about the duty-free shop https://www.youtube.com/watch?v=UpxW116QLYg). Historically tariffs have been used by governments on imported goods to protect domestic industries, generate revenue, and regulate trade. The use of tariffs dates back centuries. The Greeks and Romans used them to regulate trade and generate revenue1. In the Middle Ages, European kingdoms used them to control trade and protect local industries1. In the U.S., the Tariff Act of 1789 was one of the first laws signed by the U.S. Congress to promote trade and raise revenue2. But the grandaddy of them all is the Smoot-Hawley Act, officially titled the Tariff Act of 1930. It substantially increased U.S. tariffs across the board. Not surprisingly, other countries retaliated, and world trade shrank by an estimated 66% over 5 years3. It is one of the reasons often cited for acting as a spark plug as well as exasperating the great depression.

President-elect Trump has stated the following reasons for using tariffs4:

- Protection of domestic companies’ businesses and products

- Attracting “thousands” of foreign manufacturers to open plants in the U.S.

- Generating new federal revenue

- Stemming the flow of drugs and illegal immigration

Prior to looking at these objectives, it is imperative to understand that the exporting country does not pay the tariff. The tariff/duty is paid by the importer when the goods arrive at the dock in the U.S.5 Therefore, the importing company pays the tariff and then, in all likelihood, passes it on to the consumer.

Two papers, one from the Brookings Institution6 and the other from the Federal Reserve7, discuss the tariffs imposed in Trump’s first term and conclude that:

- “American firms and consumers paid the vast majority of the cost of Trumpʼs tariffs.”6

- “While tariffs benefited some workers in import-competing industries, they hurt workers in sectors that rely on imported inputs and those in exporting industries facing retaliation from trade partners.”6

- “Trumpʼs tariffs did not help the U.S. negotiate better trade agreements or significantly improve national security.”6

- “A key feature of our analysis is accounting for the multiple ways that tariffs might affect the manufacturing sector, including providing protection for domestic industries, raising costs for imported inputs, and harming competitiveness in overseas markets due to retaliatory tariffs. We find that U.S. manufacturing industries more exposed to tariff increases experience relative reductions in employment as a positive effect from import protection [which is] is offset by larger negative effects from rising input costs and retaliatory tariffs. Higher tariffs are also associated with relative increases in producer prices via rising input costs.”7

Bottom line, businesses and consumers paid higher prices for goods, it hurt more sectors than it helped, and there was significant retaliation. Will history repeat itself?

Here are some industries that will be impacted8, 9, 10: consumer electronics, apparel and footwear, home goods, gasoline, automotive, agriculture, transportation equipment, chemicals, minerals, construction, and small businesses. Some estimates of price increases for consumer electronics are as high as 45%! Buy those TVs now!!

Another way countries can retaliate is by focusing on specific industries and companies. The title of the following article says it all: China Has a New Playbook to Counter Trump: ‘Supply Chain Warfare’. 11

According to the article, China severed access to batteries for Skydio which produces drones in the U.S. for public safety, energy and utilities, transportation (https://www.skydio.com/solutions) and the U.S. Military, among others. Skydio now has to ration their batteries! And this was before the election. The article also states:

“Since 2019, China has created what it called an ‘unreliable entity list’ to penalize companies that undermine national interests, introduced rules to punish firms that comply with U.S. restrictions on Chinese entities and expanded its export-control laws. The broader reach of these laws enables Beijing to potentially choke global access to critical materials like rare earths and lithium — essential components in everything from smartphones to electric vehicles.”

China is prepared for a trade war!

And now we have China probing Nvidia over possible antimonopoly violations after the U.S. placed additional export controls on China’s access to high-end semiconductors (https://www.wsj.com/tech/china-nvidia-monopoly-probe-antitrust-da4f3d1f?page=1)

Will thousands of companies be moving into the U.S.? From a strategic viewpoint, companies have to consider a variety of issues when deciding where to place their footprint including, supply chain and logistics, competition, access to talent, labor cost, infrastructure and technology, local regulations and the compliance, economic and political climates12, 13. Let alone it may take years to build the appropriate facilities/factories. Further, a country can simply devalue their currency to make their products more competitive given the tariffs. The USD has appreciated since the election!

And what about onshoring? I wrote an article a few years ago, Offshoring, Outsourcing, Onshoring, Supply Chain, and Baby Formula (https://www.gfmi.com/articles/offshoring-outsourcing-onshoring-supply-chain-and-baby-formula/). Recall there was a baby formula shortage in the U.S. back in 2021/2022. 98% of the baby formula was made in the U.S. and yet there was a shortage. Local prices increased approximately11%. There also was a 17.50% tariff on baby formula. Yet the U.S. had to import baby formula to meet the demands of starving babies! Will onshoring guarantee there are no future shortages of products at a reasonable price? Or will the same shortages and price increases occur across industries? Will U.S. companies take advantage of the tariffs and increase the cost of their final product if they solely source their inputs domestically? They are capitalists, after all. Given the above, look for these factors to increase inflation.

This particular objective is difficult to quantify so I would suspect that “thousands of companies” might not be expanding into the U.S. given tariffs.

The stated goal of generating revenue is definitely achievable. But as mentioned above, the money generated will be paid by U.S. importers. The price increases will be passed along to you and me. This will cause inflation to rise.

The goal to reduce the flow of fentanyl is beyond a worthy cause. The challenges are many, not least of which is the addiction by hundreds of thousands of individuals that creates demand for drugs. Only the addict can make the decision to help themselves regardless of the level of support they receive from family and friends.

A key objective is shutting down the precursors, the chemicals required to produce fentanyl, which are exported to Mexico from China. However, Mexican drug cartels are already trying to produce these precursors by recruiting Mexican university students studying to be chemists to improve the strength of fentanyl and, more importantly, produce precursors from scratch to ultimately obtain fentanyl14. If they succeed at producing the precursors from scratch, China is out of the picture and the cartels will find ways of illegally exporting the drugs into the United Sates. This goal sounds incredible on paper, but the reality is far more complex.

Consumers and GDP

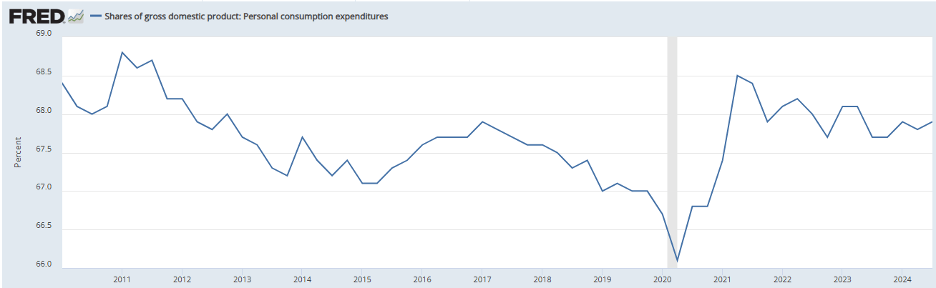

How important is the consumer to economic growth? The following chart illustrates the large piece of the pie the U.S. consumer contributes to GDP going back to 2010. Consumer expenditures range from approximately 66%-68.5% of GDP! That is a big piece of pie!

If higher prices result from across-the board-tariffs as well as the movement towards onshoring, will they impact consumer spending? That is to be determined! One thing for sure is that the consumer is incentivized to buy products today prior to any potential price increase. It would not be surprising to see an uptick in GDP for the fourth quarter of 2024 and a decrease in the first half of 2025. If this is an accurate assessment, then inflation will be up and growth will be down. Not a good combination going into the new year. The main question is how long will tariffs impact prices and trade given the experience of Smoot Hartley and the drop of trade by 66% over five years3.

Miscellaneous Factors Impacting GDP and Inflation

There are many other considerations when forecasting inflation and GDP. The incoming administration has announced their intentions to:

- Reduce a wide swath of the tax base:

- Reduction in corporate taxes

- Maintain the individual tax cuts from 2018 that are set to expire in 2025 along with not taxing social security benefits, tips, and overtime pay.

Historically, lower taxes have led to growth in GDP. If this happens, will economic growth lead to inflation?

- Reduce regulation: Will this impact businesses and consumers and ultimately GDP and inflation? In theory, less regulation should be good for growth. If so, will the growth lead to inflation?

- DOGE: Will the new Department of Government Efficiency (DOGE) impact the budget deficit? If so, will less government spending impact markets, GDP, and inflation? This is more nuanced but will most likely impact the U.S. Treasury curve. In theory, a lower budget deficit will lead to less issuance of U.S. treasuries. Less supply would push prices higher/interest rates lower. This would lower corporate debt/interest expense burdens. In addition, lower interest rates would help the housing market. A strong housing market leads to growth. If so, will the growth lead to inflation?

- Deporting illegal immigrants: How will the deportation of illegal immigrants impact businesses such as construction especially given the shortage of housing in the country? A recent article in the Wall Street Journal15 summarized the challenge:

- The construction industry is facing a double whammy of tariffs and deportations, which could lead to a labor shortage and higher costs for home buyers.

- Undocumented workers make up an estimated 13% of the construction industry, and their deportation could leave many positions unfilled.

- Tariffs on imported construction materials, such as steel and lumber, could also increase the cost of building homes.

I will leave it to the reader to decide if this inflationary!

- If foreign policy becomes isolationist, how will the changes in the military impact trade given the strong correlation between a strong military and trade, specifically, U.S. exports?

- Lastly, the BRICS (Brazil, Russia, India, China and South Africa are the original BRICS countries but there are now others that come under this banner) are potentially pursuing an alternative to the U.S. dollar. If successful, this could have profound effects on the USD, which is considered the world’s reserve currency. President-elect Trump has threatened 100% tariffs on these countries if they create an alternate currency to the USD16.

Conclusion

It is possible that President-elect Trump is using tariffs as a bargaining chip. On the other hand, if he is not, the final outcomes related to tariffs will be quite dynamic. There are so many moving parts, it will be difficult to accurately forecast a precise outcome. But history certainly has shown us that tariffs will result in higher inflation which will not be good for GDP. Not to mention China’s playbook will be noticeably different going forward!

References

- https://en.wikipedia.org/wiki/Tariff?form=MG0AV3

- https://news.law.fordham.edu/jcfl/2019/03/17/a-brief-history-of-tariffs-in-the-united-states-and-the-dangers-of-their-use-today/?form=MG0AV3

- https://www.wita.org/blogs/did-the-smoot-hawley-tariff-cause-the-great-depression/#:~:text=Eighty%20four%20years%20ago%20on,U.S.%20tariffs%20on%20some%20890

- https://www.cbsnews.com/news/trump-tariffs-mexico-canada-china-truth-social/

- For an interesting article on this topic go to: https://www.wsj.com/economy/trade/trump-tariff-rates-china-world-trade-charts-3d6aee09?mod=Searchresults_pos2&page=1

- https://www.brookings.edu/articles/did-trumps-tariffs-benefit-american-workers-and-national-security/14

- https://www.federalreserve.gov/econres/feds/files/2019086pap.pdf

- https://www.msn.com/en-us/money/markets/trump-s-tariffs-will-likely-see-gmailahese-seven-products-become-more-expensive/ar-AA1uMys1?form=MG0AV3

- https://www.msn.com/en-us/money/markets/small-businesses-brace-for-impact-as-trumps-tariff-plans-loom/ar-AA1vdiDI?form=MG0AV3

- https://www.cbsnews.com/news/trump-tariffs-consumer-prices-inflation-impact-what-to-buy-now/

- https://www.nytimes.com/2024/11/27/business/china-retaliation-skydio.html

- https://productdistributionstrategy.com/what-to-consider-when-expanding-a-business-internationally/?form=MG0AV3

- https://www.scaling.partners/resources/articles/what-to-consider-when-expanding-a-business-internationally/?form=MG0AV3

- https://www.nytimes.com/2024/12/01/world/americas/mexico-fentanyl-chemistry-students.html

- https://www.wsj.com/economy/trump-immigration-deportation-policy-construction-impact-b8db1120?mod=Searchresults_pos1&page=1

- For a broader discussion on fiat currencies, Gold and Bitcoin go to: https://www.gfmi.com/articles/gold-bitcoin-digital-gold-and-fiat-currencies/

About the Author: Ken Kapner

Prior to starting GFMI in 1998, Ken spent 14 years with the HSBC (Hong Kong and Shanghai Banking Corporation) Group in their Treasury and Capital markets area where he traded a variety of instruments including interest rate derivatives, spot and forward foreign exchange, money markets; managed the balance sheet; sat on the Asset Liability Committee; and was responsible for the overall Treasury activities of the bank. He later headed up HSBC’s Global Treasury and Capital Markets Product training for two years in Hong Kong. Specifically, his responsibilities included developing new courses and delivering courses to traders, support staff and relationship managers. In New York, he established a training department for the firms’ Securities Division where he was in charge of the MBA Associates Program, continuing education and Section 20 license.

He has co-authored/co-edited seven books on derivatives including The Swaps Handbook and Understanding Swaps.

Download article