It’s 420

In 1971 five high school students in San Rafael, California agreed to meet at a wall across the street from their high school. They called themselves the Waldos, and their objective was to find an abandoned cannabis crop using an old map created by the grower. The time they agreed to meet was 4:20.

Today “420” is synonymous with marijuana counterculture and 4/20 or April 20 has become an unofficial international holiday where people gather around the world to celebrate and consume cannabis.

Cannabis is known by many names: pot, mary jane, reefer, bud, weed, or just plain marijuana. It is a controversial herb with both medicinal and recreational properties. Cannabis contains over 130 distinct compounds. The most prevalent are tetrahydrocannabinol (THC) and cannabidiols (CBDs). Like all plants, cannabis can be engineered to provide a desired effect. As an example, the plant can be grown rich in THC, the psychoactive compound in cannabis, or lower in THC and richer in other medicinally engineered components. THC will create a euphoric feeling sometimes called a high, while CBD does not have that affect. So, some cannabis won’t get you stoned no matter how hard you try.

Its medicinal benefits are recognized and its medical use is legal in Australia, Chile, Germany, Greece, Italy, Norway, the Netherlands, Peru, Poland, Sri Lanka, and the United Kingdom. It is legal for recreational use in Uruguay, Canada, South Africa, and the country of Georgia.

In the United States, ten states have legalized pot for recreational use, 33 allow it for medicinal applications, and other states may be moving that direction.1, 2Today, more than half of the citizens of our country are living under state law that directly conflicts with federal law. The current clash between states’ legislative rights and federal regulation is resulting in “laboratories of democracy”.3

This has created an interesting challenge for investors, advisors, fiduciaries, and bankers. The financial markets, as well as many investors, see the industry as a new opportunity and perhaps the fastest growth opportunity since the dot.com era.

The Marijuana Related Business (MRB) industry is yet to be precisely and practically defined. Tilray (TLRY) was the first cannabis IPO in the USA, experiencing a skyrocketing run from $22.10 (July 31, 2018) to $214.06 in under 2 months. Though this meteoric rise has fallen back below $80, expect more excitement, more players, and more regulations as big business and additional states get into the game.

It’s Intoxicating

Laws that attempt to control intoxicating substances are known as sumptuary laws; regulations and decrees created to prevent and discourage consumption. The prohibition of ingesting certain drugs and alcohol is sometimes considered a benefit to society in general, and is on occasion, a religious requirement.

The prohibition of alcohol under Islamic or Sharia law dates back to the 7th century, but some jurisdictions accept the use of hashish for medicinal and therapeutic purposes. The Ottoman Empire briefly prohibited coffee as an intoxicant in the mid-1600s. In 17th century England coffee drinkers were associated with seditious political activities, leading to a ban of coffeehouses. Asian countries prohibited the use of opium, until many were forced to allow consumption and support the British opium trade monopolies. This would ultimately lead to the First and Second Opium Wars with China (1839-1842 and 1856-1860 respectively).

In the United States, alcohol was prohibited nationally from 1920 until 1933.4The first anti-drug law in the U.S. was created in San Francisco in 1875, banning opium smoking in opium dens. But it was the Pure Food and Drug Act of 1906, and the notion of consumer protection, that ultimately led to regulation and prohibition of certain addictive substances.5

It’s a Drug

The Pure Food and Drug Act (1906) created the Food and Drug Administration with the specific objective of banning foreign and interstate traffic in altered or mislabeled food and drug products. Under the Act, product labels were mandated to clearly list any of ten ingredients deemed “addictive” and/or “dangerous” on the product label. These included alcohol, morphine, opium, and cannabis.

Hundreds of individual laws were passed providing more definition, and were collectively known as the “poison laws.” The poison laws were designed to limit and restrict the sale of “addictive” and “dangerous” substances to pharmacies, by requiring a doctor’s prescription. Prior to the change, drugs had been sold as patent medicines with secret ingredients and often misleading statements about benefits.

It’s International

By the early 1900s the U.S. had become an important player on the international stage and looked beyond its own borders. The 1912 International Opium Convention addressed consumption, addiction, and the distribution of opium around the world. The result was an international agreement to regulate the trade of opium and other addictive substances across international borders.

Two years later, Secretary of State William Jennings Bryan promoted the Harrison Narcotics Tax Act. The bill said very little about addiction and instead emphasized the importance of upholding the new international agreement. As an added benefit though, it offered the promise of new revenue by imposing a special tax on those involved in the production and distribution of opium and coca leaves, and their derivatives.6

A second conference held in1925 wherein it was presented that the use of Indian hemp and its preparations derived could only be authorized for medicinal and scientific purposes.7The text wasn’t accepted when the delegation from India pointed out that hemp was essential for social and religious customs, but India promised to limit export to governments using an import certificate system.8

As a result, and under the law, consumption of narcotic drugs was not illegal, but possession could be a tax violation if it had been purchased from an unlicensed source. Sales could only legally be made with authorization, a license, and the payment of a tax.

It’s Criminal

Criminalization of cannabis in the United States was born from regulation at the state level by removing poison law “loopholes” that allowed consumption. Ironically, many of the states that barred use and implemented prohibition are the same states that have today sanctioned legalization for medicinal and recreational use.

The first state to criminalize possession and consumption wasn’t a state at all, but a federal district, the District of Columbia (1906) followed by California (1907), and soon after Massachusetts (1911), Maine and New York (1914), and it progressed from there. By 1925 drafts of a Uniform State Narcotic Drug Act were circulating with a fifth and final version adopted by nine states in 1932.

It’s a Narcotic

In 1930 The Federal Bureau of Narcotics was created as an agency of the U.S. Department of Treasury. It was the predecessor to the Drug Enforcement Agency we know today.

The first cannabis specific federal law, the Marihuana Tax Act (1937), utilized tax as a tool to control the industrial use of cannabis products. Due to high taxes, small hemp producers were virtually at risk for going out of business. Ironically, the first major U.S. city to legalize recreational cannabis, Denver, was also the location of the first cannabis arrest attributed directly to the Marihuana Tax Act.

It’s an Industrial Product

Cannabis hemp fiber is an important industrial product used in fabric, shoes, paper, building material, and rope. The American Medical Association (AMA) opposed the Marihuana Tax Act because taxes were imposed on physicians prescribing medical cannabis and retailers selling medical cannabis. When a major producer of hemp fiber, the Philippines, fell to Japanese forces in 1942, the Department of Agriculture and the U.S. Army released a film that explained the benefits of hemp and urged farmers to grow as much as possible without any change to the Marihuana Tax Act.9

Perhaps the real goal behind the Marihuana Tax Act was to destroy the hemp industry, and medicinal & recreational prohibition was only a byproduct. Andrew Mellon, Secretary of the Treasury when the Act was passed, was the wealthiest man in the world. Mellon and the DuPont family had invested heavily in a new synthetic fiber called nylon. Nylon’s only real competitor was hemp. Another theory is that the competitive industry was the paper industry. If hemp was a cheap alternative to timber for paper, then the significant investments in timber and newspapers by Mellon, Dupont and a newspaper tycoon, William Randolph Hearst, were at risk. Another heavy investor in newsprint and timber was Harry Aslinger, Chief of the Narcotics Bureau. It was Aslinger who would make the case before the Ways and Means Committee in 1937.

There has long been a misconception about industrial marijuana and hemp fiber. As previously mentioned in this article, the intoxicating effects of THC isn’t present in all cannabis strains. Industrial hemp comes from strains with very minimal amounts of THC, making it nearly impossible to get high “smoking a rope.”

Nevertheless, the U.S. is growing hemp again, due to a provision in the 2014 Farm Bill which removed it from the Controlled Substances Act. With demand for hempseed oil, and as a strong fiber for automotive door panels, insulation and other products, profits can be upwards to $250/acre.10

It’s a Tsunami

In 1970 Congress passed the Controlled Substance Act. The CSA assigned marijuana as a Schedule I controlled substance, along with heroin, LSD, and peyote, meaning it has the highest risk for abuse and absolutely no accepted medical benefit. Today it retains this status, and federal cannabis law enforcement efforts continue under the Act. A new bill, House Resolution 2020, is attempting to reschedule the status, placing marijuana as Schedule III (lower abuse potential, current accepted medical use, and low/moderate risk of dependency/abuse).11

Meanwhile at the state level, there’s been a tsunami of change.

Change started with decriminalization of cannabis by Oregon and Texas in 1973, followed by Alaska, Maine, Colorado, California and Ohio in 1975. By 1990 Minnesota, Mississippi, New York, North Carolina, Nebraska, and South Dakota followed the same path. In 1978, New Mexico formally recognized the medical value of marijuana, and in 1979 Virginia allowed doctors to prescribe the substance for glaucoma and the effects of chemotherapy.

It’s Legal

The legalization of marijuana for recreational use was first passed in Colorado and Washington in 2012; today ten states recognize and allow recreational use of cannabis. Other states, U.S. Territories, some cities, and even Indian tribes have taken measures to decriminalize or legalize cannabis for medical and/or recreational use.

This is where we are today. The CSA applies to the nation as a whole and to all 50 states and U.S. territories, but contrary state and local laws are in effect within the borders of some states or other jurisdictions.

When states and federal laws disagree, they are in conflict, the supremacy clause of the U.S. Constitution kicks in.

The Supremacy Clause

Article VI, Clause 2 of the Constitution specifies that federal laws and treaties made “under the Constitution” are the supreme law of the land, and states cannot interfere. It provides that federal law supersedes state law when there is conflict between state laws.

We are a federalist government, which means that citizens of the nation are subject to the powers of state and local governments. This system allows two or more governmental bodies to have control over citizens when jurisdiction overlaps. However, according to the clause, when Congress legislates pursuant to its delegated powers, conflicting state law and policy must yield.12

The Supremacy Clause is intended to prevent, or to deal with, conflicts of law that might arise between the federal and state governments, especially with respect to trade across borders. This broad brush can create confusion — and this is where we are today with marijuana related law and the impact of federal laws on MRBs.

Federal Law and States’ Rights

This conflict in jurisdiction first came to a head when Colorado passed state Amendment 64 which legalized the recreational sale and use of marijuana. From the mile-high state capitol, local law and local enforcement changed. In December 2014, the neighboring states Nebraska and Oklahoma filed a civil lawsuit to invalidate Colorado law. The argument was based on the federal jurisprudence.

The bordering states asked that the U.S. Supreme Court take the case, as the only court that could properly hear a dispute between states. The lawsuit cited the Supremacy Clause, which gives the federal government preeminent authority to regulate interstate commerce, and that includes the trafficking in drugs.

Law enforcement officials in Kansas added their concerns to those of Nebraska and Oklahoma. But, because Colorado had in effect legalized a substance still illegal in those states, it was argued that Colorado law increased the burden of policing and enforcing their own jurisdictions. The argument was simple: Colorado’s Amendment is in violation of the Controlled Substances Act because marijuana remains a Schedule 1 drug.

Bud Out!

The United States Solicitor General filed an amicus brief urging the complaint not be heard and urged the court to stay out of the case, citing “Our Federalism” is based on “the belief that the National Government will fare best if the States and their institutions are left free to perform their separate functions in their separate ways.”13

On March 21, 2016, the U.S. Supreme Court denied Nebraska and Oklahoma’s motion, leaving no challenge to Colorado’s legalization. Time has passed and next year it is expected that legislation will be introduced in Nebraska to legalize medicinal cannabis.

Will the legal status for pot change on a federal level?

The Cole Memo

On August 29, 2013, a memo circulated to all U.S. attorneys from then Attorney General James M. Cole stating that, given its limited resources, the Justice Department would not enforce the federal marijuana prohibition in states that have “legalized marijuana in some form and…implemented strong and effective regulatory and enforcement systems to control the cultivation, distribution, sale, and possession of marijuana.”14The DOJ had gone on record that it would not challenge state legislation, except where a lack of enforcement might undermine federal priorities, such as:

- Distribution to minors;

- Revenue from marijuana sales going to criminal enterprises, gangs, and cartels;

- Prevention of violence and the use of firearms in cultivation and distribution;

- Prevention of drugged driving and other adverse public health consequences;

- Prevention of growing and associated safety and environmental issues on public lands or use on federal property.15

The Cole Memo emphasized Federal government focus on public safety and protection of federal jurisdictions, but if state law adequately addressed those issues, the Cole Memo supported turning a blind eye to the differences between federal and state mandates.

The Rohrabacher-Blumenthal Amendment

The blind eye was formally legislated with passage of the Rohrabacher-Blumenthal Amendment in 2015, also known as the Rohrabacher-Farr Amendment. The Amendment was noted for bipartisan support in an era when any collaboration is rare. The Republican-introduced legislation, which requires an annual renewal, prohibits the Justice Department from interfering with state medical cannabis laws, but it is silent on recreational cannabis law and enforcement. The law passed the House with the support of 67 Republicans and 175 Democrats.

The Senate version introduced by Republican Senator Rand Paul and Democratic Senator Cory Booker never made it to a vote, but the bill was attached to an omnibus spending bill. It was signed into law on December 16, 2016.

The Sessions Memo

On January 4, 2018, a new direction emerged. Attorney General Jeff Sessions issued his own memorandum ordering federal prosecutors to enforce the “significant penalties” designed to prohibit “cultivation, distribution, and possession of marijuana.”16Federal prosecutors were once again expected to enforce and recommend sentencing for marijuana related offenses under federal guidelines for cannabis as a Schedule 1controlled substance. Back to the CSA!

Sessions made it very clear that the shift in policy was immediate, stating emphatically that any “previous nationwide guidance specific to marijuana enforcement is unnecessary and is rescinded, effective immediately.”

Sessions had previously been vocal about his opposition to cannabis in any form. In an April 2016 Congressional hearing, Session noted that “. . . good people don’t smoke marijuana.” He continued, “we need grown-ups in charge in Washington to say marijuana is not the kind of thing that ought to be legalized . . .”17

A year after releasing his memo, Sessions would be gone and enforcement of his decree in question. We have yet to hear formally from a new Attorney General, but Attorney General candidate William Barr signaled in his confirmation hearings that he would not target law-abiding marijuana businesses in enforcement.18Although he emphasized his personal opposition to legalize pot, he noted that limits to federal enforcement, when supported by state mandate, was the best long-term solution in addressing disparate state and federal law.

Taking Pot Seriously

Whatever your position, marijuana sales and profits do proliferate in states where legalization predominates — creating new issues for local jurisdictions, significant new tax revenues, and investment opportunities.

But wait — MRBs are struggling to find banks with which to do business. In fact, as a result many MRBs are forced to be cash based, creating not only operational issues, but also public safety concerns in the movement of cash. It also limits the opportunity for funding within the industry and capital for lending beyond it. Under federal law, any financial institution providing a service to an MRB technically runs the risk of federal prosecution for aiding and/or abetting a federal crime.

How far can these business tentacles reach? Consider the number of businesses that might support MRBs directly or indirectly: from cleaning service firms to marketing groups; from accounting and payroll support to construction firms. What about utilities proving electricity and water, or the companies that make fertilizer?

Here’s something to put into your pipe and ponder on: Government itself is collecting taxes from marijuana growing and distribution businesses, and more taxes from businesses related to MRBs. By extension, then, has the government itself become an MRB?

With billions of dollars passing through these businesses, is it high time to align federal and state law? There are opportunities, but there remain risks. Federal Anti-Money Laundering laws still provide criminal liability against anyone or any firm that engages in financial transactions with knowledge that the property involved represents proceeds from an illegal activity, including marijuana sales.

Mitigating Risk and Advantaging Opportunity

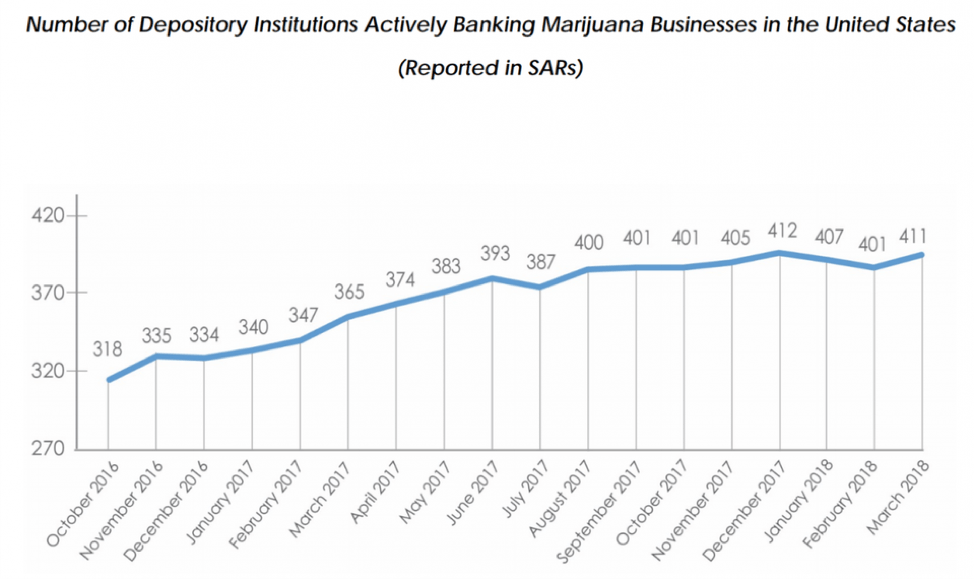

Until marijuana is legal at a federal level, or Congress addresses the issues through legislation, any path for financial service providers working with MRBs will be risky. Some risk can be mitigated by understanding the sector before participating in it. However, that has not precluded various banks and credit unions from taking the risk to work with MRBs, as shown in this graph:

Source: https://www.fincen.gov/sites/default/files/shared/3rd%20Q%20MJ%20Stats.pdf

Until the discrepancy between the Cole and Sessions memos is resolved once and for all, it is unlikely that any clear guidance will be provided by our federal regulators.

The SEC

The SEC recognizes and takes seriously its duty to protect investors. Despite the rift between state and federal law there are over 50 publicly traded MRBs registered with the SEC. However, the vast majority of MRB stocks are traded over-the-counter as small cap companies not subject to the same disclosure requirements as the larger firms. With legalization and an interest in MRBs, new investors have flooded the emerging market.

The SEC is focused on improving disclosure and transparency. In May 2014, the SEC suspended trading in five MRBs on charges of fraud and market manipulation. At the same time, it issued an investor alert on the risks of investing in the federally prohibited industry.19The SEC has not ignored the interest and threat to the public for which it was established to protect.

Treasury and the Fed

The OCC has not provided specific guidance on MRBs for banks under its jurisdiction, although it hasn’t shuttered any firms as a result of doing business with MRBs. Although clear direction remains obscure, the pressure on financial service firms is growing. Hunger for new tax revenue and the real need for public safety has led many to believe that federal laws will have to change. In the meantime, the established legal wall appears to be cracking.

In early 2018, the Federal Reserve Bank of Kansas City granted conditional approval for Fourth Corner Credit Union, based in Colorado, to provide services for marijuana-linked businesses. Not a bridge, but a first step. Fourth Corner plans to service individuals and companies that support or assist legalized marijuana, including landlords, vendors and accountants and not state-licensed dispensaries. The Federal Reserve Bank of Kansas City noted that the action is not an indication of the views of [the Fed], and is not meant to contain any supervisory, regulatory or enforcement guidance. It should be noted that the approval applies to ancillary firms only and not growers or distributors.20

FinCEN

The U.S. Treasury’s Financial Crimes Enforcement Network (“FinCEN”) has issued guidance, clarifying Bank Secrecy Act (“BSA”) issues — perhaps as a result of the inherent exposure to money laundering, public safety issues, and the interest of state governments to reduce the high volume of cash passing through MRBs.21A 2014 memo specifies three phrases for describing a financial institution’s relationship with MRBs in the filing of Suspicious Activity Reports (SARs), which remain an industry requirement for any business associated with the industry. FinCEN has established the following parameters:

- A Marijuana Limitedfiling means the financial institution’s due diligence indicates that the MRB does not raise any of the typical red flags and is compliant with the state’s regulations regarding marijuana businesses.

- The Marijuana Priorityfiling means the financial institution’s due diligence indicates that the MRB may raise one or more of the red flags and may not be fully compliant with the state’s regulations.

- The Marijuana Terminationfiling means the financial institution’s due diligence indicates the MRB raises one or more of the red flags and is not fully compliant with the state’s regulations regarding MRBs. In such cases the financial institution should terminate its relationship with the MRB.

- Red Flags to Distinguish Priority SARs: Nearly a dozen “red flags” are listed, based upon the potential for activity that violates state law or implicates one of the Cole Memo priorities. Although not exhaustive by their own admission, FinCEN asserts the need for thorough customer due diligence.

Bud or Bud Lite

Until marijuana is legal at the federal level, or Congress passes legislation to remove or address the gaps between federal and state mandates, investing in or providing financial services will remain risky. But that risk can be minimized via education and a robust compliance program.

Those firms willing and able to take on the risk may create a new and sustainable profit base, build new long-term relationships, and even assist the community with public safety issues. They will also provide indirect assistance to those folks who receive real benefits from the medicinal attributes of cannabis.

As with any investment, there is the issue of balancing risk with rewards. And with MRBs, such an endeavor must be set at the Board level, based on risk appetite, and supported clearly by policy and procedure, a solid customer identification program, training, effective due diligence, and complete and thorough documentation.

The alternative of course, is to just say no.

Footnotes

1https://disa.com/map-of-marijuana-legality-by-state

2Angell, Tom, These States Are Most Likely To Legalize Marijuana in 2019, FORBES, December 26, 2018, https://www.forbes.com/sites/tomangell/2018/12/26/these-states-are-most-likely-to-legalize-marijuana-in-2019/#5d3636f35add

3New State Ice Co. v. Liebmann, 285 U.S. 262 (1932)

4https://www.archives.gov/historical-docs/todays-doc/?dod-date=1205

5https://history.house.gov/Historical-Highlights/1901-1950/Pure-Food-and-Drug-Act/

6Public Law No. 223, 63rd Cong., approved December 17, 1914.

7League of Nations (1923–25). Advisory Committee on Traffic in Opium and Other Dangerous Drugs: Minutes of the 1st to 7th Sessions. Geneva: League of Nations

8https://www.unodc.org/unodc/en/data-and-analysis/bulletin/bulletin_1962-01-01_4_page005.html

9https://www.youtube.com/watch?v=d3rolyiTPr0

10https://www.latimes.com/opinion/op-ed/la-oe-fine-hemp-marijuana-legalize-20140626-story.html

11https://www.dea.gov/drug-scheduling

12https://www.govinfo.gov/content/pkg/GPO-CONAN-1992/pdf/GPO-CONAN-1992-9-7.pdf

13Younger v. Harris, 401 U.S. 37, 44 (1971)

14, 15https://www.justice.gov/iso/opa/resources/3052013829132756857467.pdf

16https://www.justice.gov/opa/press-release/file/1022196/download

18Sara N Lynch, US Attorney General Nominee Will Not Target Law-Abiding Marijuana Businesses, Reuters, January 15, 2019

19https://www.sec.gov/oiea/investor-alerts-bulletins/ia_marijuana.html

20https://www.nafcu.org/newsroom/fed-approves-fourth-corner-cus-request-serve-marijuana-advocates

About the Author: Michael Daly

His professional alliances include various assignments, such as Chair of the American Banking Association’s Certification of Securities Operations Professionals (CSOP) for 10 years, and having been a two-term board member of the Fiduciary and Investment Risk Management Association (FIRMA). Michael has written numerous professional articles, has delivered speaking engagements and training sessions, and has an MBA in International Business.

Michael holds a BS in Business Administration from the University of Redlands and a Masters in International Management from the American Graduate School of International Management.

Copyright © 2019 by Global Financial Markets Institute, Inc.

Download article