For several years now, and as expected, numerous studies on the annual trends in the wealth management industry have been published, of which all of them – without exception – continuously emphasize the importance of embracing digital wealth management or to expect extinction. Last December, Capgemini, a technology services and digital transformation consulting firm, in the wealth management space, released its “Top-10 Trends in Wealth Management: 2019” annual report. Nine out of the ten trends discussed were directly related to technology in some form or another. Likewise, earlier this year, Aite Group, a research and advisory firm, published its “Top 10 Trends in Wealth Management 2019: Revisiting the Value Chain.” In this publication, eight out of the ten trends identified were either directly or indirectly related to technology. In both instances, subjects ranged from Machine Learning, Artificial Intelligence, use of virtual tools, developing digital models that leverage client data for enhanced customer experience, to the use of Big Data and IoT (Internet-of-Things) – all enabling wealth management firms to fully automate portfolio management and customer experience. Yet, it’s important not to lose sight of the fact that these key trends in technology represent a continuation of what has been evolving for more than a decade in the wealth management sector – particularly with the rise of Robo-Advisors, post Financial Crisis of 2007.

Since the Financial Crisis, Robo-Advisors started to earn lots of glamour for having been able to deliver economical online investment solutions to investors. Interest in Robo-Advisors was further propelled by the mistrust investors had in financial institutions after the 2007 market collapse, which ultimately led to the Great Recession. Consequently, Financial Advisors (FAs) across the industry were obliged to go through a lengthy trying period to earn back the trust from their clients. Lots of negative headlines were being published in the media calling for the end of the financial advisor as we know it or alarming wealth managers that Robo-Advisors are coming to take over the business. Until late last year, many FAs or wealth advisors continued to worry that their jobs would ultimately be replaced by Robo-Advisors. As one further examines this fear, one gets to distinguish between the FAs who see the “glass half full” versus those who see it “half empty.”

As of late, Robo-Advisors have somewhat fallen from grace – particularly with the regulators. Last May, the UK Financial Conduct Authority (FCA) issued a warning to “a group of automated financial advisers” for misleading investors on pricing and for lack of having an adequate suitability assessment framework in place (FT.com). On December 21, 2018, the US Securities and Exchange Commission fined two prominent Robo-Advisors; namely, Wealthfront Advisers and Hedgeable. The former was reprimanded for misleading and deceitful marketing and for having an inadequate compliance program in place, while the latter was fined for misleading performance reporting (FT.com). Moreover, when looking at the overall size of the Wealth Management Sector globally, regionally or domestically to the US, Robo-Advisors have barely made a dent in terms of an industry of trillions of dollars in assets-under-management (AUM).

Before deepening further on this fascinating subject covering Robo-Advisory, it’s imperative to highlight – at this juncture – that the intent of this article is to limit the discussion to what impact Robo-Advisors are having on FAs in the wealth management industry. After meeting numerous FAs and private bankers in the last year or so, the insurgence of Robo-Advisors continues to be a concern. But what also became apparent is the lack of understanding, by many, of what Robo- Advisors are and what they do. This, in turn, possibly explains why the benefits that Robo- Advisory could potentially bring to the table are not being considered by many FAs. According to a white paper published, in 2016 by Advent – a software company and longtime player in the wealth management space – only a surprising 19% of the FAs interviewed for a study conducted by Pershing believed that robo-advice would complement their practices (SS&C Advent). The same paper also cites a study by InvestmentNews in partnership with BlackRock, that “of the more than 400” FAs surveyed, “43% said robo-advice will have no impact on their business. Meanwhile, 39% see robo-technology platforms as an opportunity (primarily as a marketing tool to attract clients), compared to the 18% that view them as a threat.” (SS&C Advent) Hence, based on the mixed-signals detected from private encounters with FAs and private bankers, backed by the studies to be referred to herein, it may make sense to present a general overview of Robo-Advisory in the wealth management sector. The goal here is to portray a clearer picture on the evolution of Robo-Advisory – especially for those that may not be as familiar with robo- advice. For those who know this subsector, the hope is that this article will serve as a refresher. The ultimate purpose of this article is to bring forth acceptable arguments on how Robo-Advisors could benefit wealth managers or independent FAs alike.

Definition and History of Robo-Advisory

According to Knowledge@Wharton, a University of Pennsylvania online publication, Robo- Advisors “are online services that uses algorithms to automatically perform many investment tasks done by a human financial advisor.” Similarly, Angela Scott-Briggs, in her article “What is a Robo-Advisor, Origin and History?”, published by TechBullion on November 24th, 2016, defines Robo-Advisors as “online wealth management services that offer computerized, algorithm-based portfolio management without using human financial planners.”

In a discussion paper called “Emerging Models of Digital Wealth Advisory,” published by Deloitte and Avaloq, on April 10, 2017, the term Robo-Advisory is further put into context by defining it as “an online portfolio management solution that aims to invest client assets by automating client advice.” (Deloitte) Likewise, multiple other publications on the evolution of wealth management often refer to Robo-Advisory as digital wealth management while replacing the term Robo- Advisor with digital asset manager. Thus, one could simplistically conclude that Robo-Advisors are automated investment services comprised of capabilities to invest in model portfolios with semi- or automatic rebalancing features. Deloitte’s study also brings forth an important point to be kept in mind – that is, not all Robo-Advisors are the same. They may differ according to four key factors: Target Group (e.g., mass affluent segment), Investment Philosophy (e.g., passive versus active investing), Service Level (e.g., guided online-investing vs automatic online-investing based on goal and risk profiling), and Individualization (i.e., customization for those that require guidance or are financially-sophisticated).

The first Robo-Advisors are believed to have been created in 2008 by tycoons in Silicon Valley, in response to the 2007 Financial Crisis which – at that time – had brought to light the excesses in sales of complex investment products, with built-in layers of hidden fees, to financially unsophisticated investors. Because of the Financial Crisis, investors remained highly averse to risky investments which, in turn, empowered these venture capitalists to tap right into this opportunity and propel Robo-Advisory into a trending new business.

But, according to Gary Karz, CFA, during a presentation he gave at the San Diego Chapter of the American Association of Individual Investors (AAII), on October 8th, 2015, the first pioneering company in Robo-Advisory was founded in 1996 by Financial Engines. After visiting Financial Engines’ website, they do indeed claim to have launched “the first independent online advice platform” in 1996 – focused on retirement planning for investors at all levels of wealth (financialengines.com). One could debate either way; but, automation of portfolio management was not necessarily new during or after the Financial Crisis. From my personal experience as a private banker over two decades ago, the feature of automatic rebalancing of model investment portfolios was indeed around – but obviously it was not data- or AI-driven. Human intervention was the leading factor.

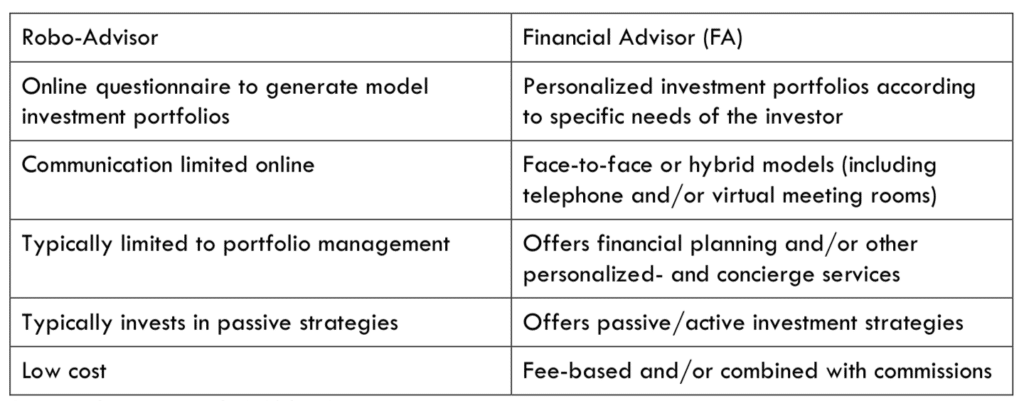

To stay aligned with the purpose of this article, one must also be able to distinguish the key differences between what Robo-Advisors do versus what FAs do. Again, Gary Karz, during his presentation at the San Diego Chapter of the AAII, did a great job summarizing these differences that could still be considered valid today (which appear rephrased and tabled below for ease of comparison):

Source: Gary Karz, CFA (2015)

General Overview of the Wealth Management Landscape

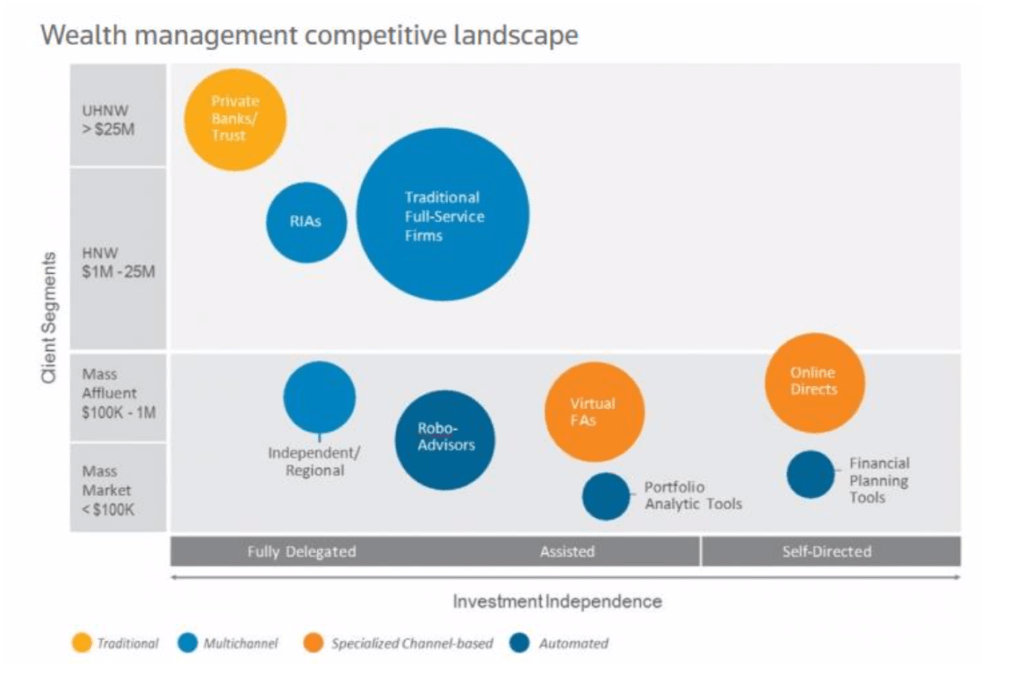

In figure 1 (below), Thomson Reuters does a great job in categorizing – along the vertical axis – the key players in the wealth management space according to Client Segments (i.e., Mass Market, Mass Affluent, HNW and UHNW) versus Investment Independence along the horizontal-axis. The main message here is that Robo-Advisors, along with other digital or online business models, are fit for purpose in serving the Mass Market and Mass Affluent. In addition, depending on the level of engagement by the client in the investment process, Robo-Advisors typically cater to clients that prefer to partially delegate their investment decisions to a wealth manager. This portrayal aligns with the general consensus that automated services are a more cost-effective manner in servicing smaller investment accounts. Another way of looking at it is that the wealthier the investor, the least they tend to seek robo-advice and seem to opt for personalized financial advice provided by FAs or private bankers.

Figure 1

Source: Thomson Reuters (2015)

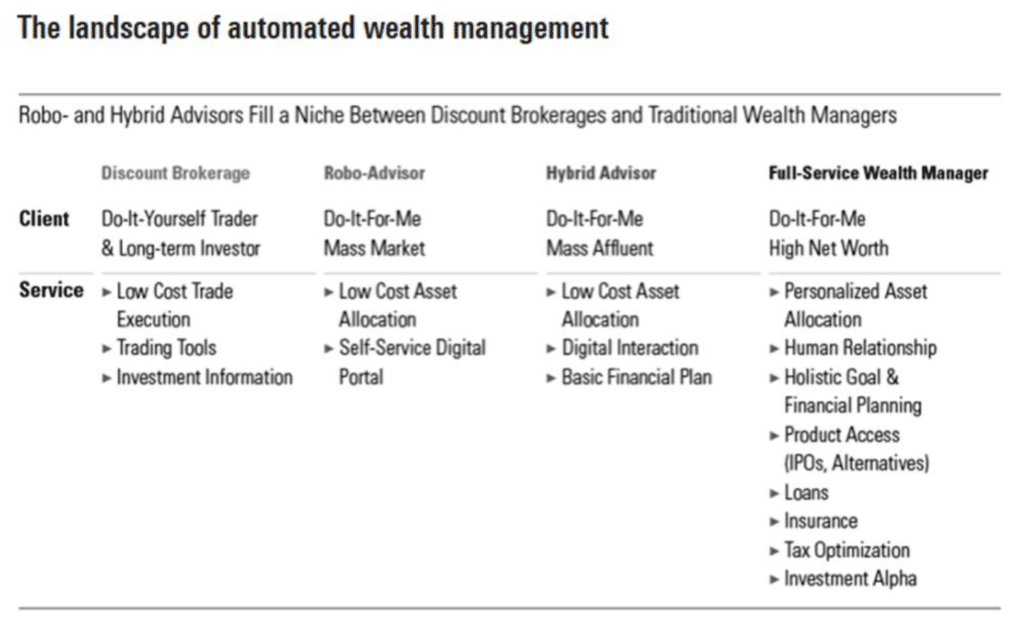

In Figure 2 (below), Morningstar breaks down digital wealth management into four types of service providers – where three of the four are targeting investors that prefer to delegate their investment decision process to a wealth manager. These clients are also commonly referred to as “delegators” or “those [investors] who do not wish to form any part of the advice process.” (Journal of Financial Planning) Not different from the previous analysis, this illustration corroborates that Robo-Advisors are well positioned to service the Mass Market. It also validates Hybrid Advisors as a new group of prominent players tending to the Mass Affluent. Hybrid Advisors are a rising business proposition where either Robo-Advisors are adding FAs into the mix of services they offer or – vice-versa – where FAs are complementing their financial planning services with Robo-Advisory capabilities. Discount Brokerages, on the other hand, plainly focus on customers that are self-directed or self-reliant. Lastly, Figure 2 further ascertains that the wealthier the client, the higher the demand is for personalized services.

Nonetheless, one should not ignore that high-net-worth-individuals (HNWI) still expect progressive digitalization of the business delivery model. Surveys conducted by Capgemini, during late 2017 and early 2018, further supports the notion that interest in the hybrid advice model remains strong at the global level – compared to the year before – with “more than 50% of HNWIs” surveyed responding that “it was highly important” to them while “38.7% of survey respondents citing it was moderately important.” (Capgemini, World Wealth Report 2018) According to Aite Group, “the year 2019 will see [many Hybrid Advisors] shift from a simple hybrid platform to a high-touch hybrid platform.”

Figure 2

Source: Morningstar (2018)

Latest Trends in Robo-Advisors

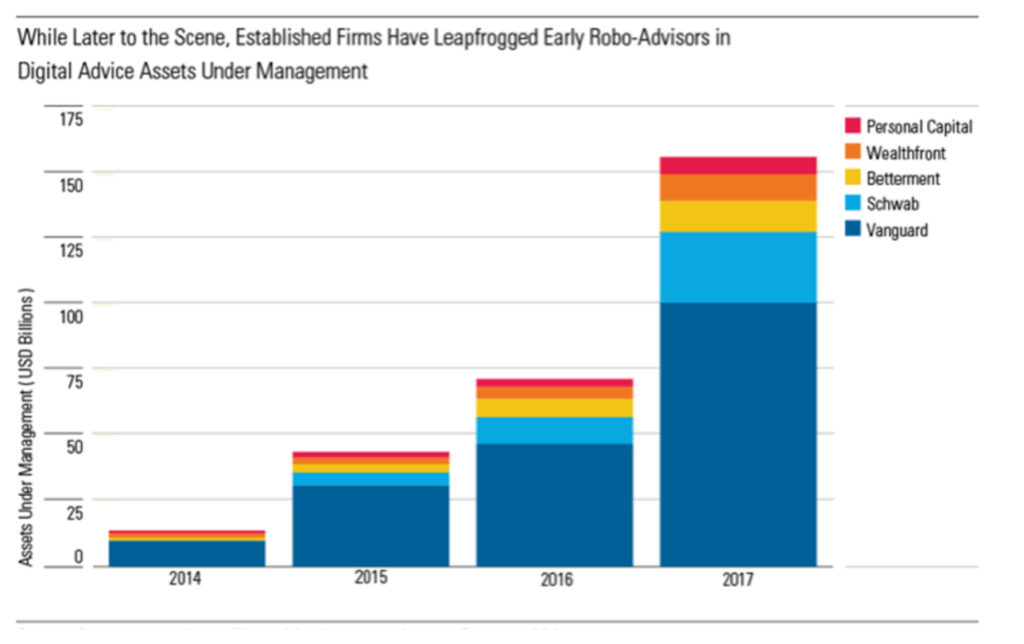

Knowledge@Wharton reports that “[Robo-Advisors] are a fast-growing trend but they still command a small share of the market.” In 2016, they reported that US Robo-Advisors were managing $126 billion in assets. From all the research conducted for this article, no exact figure could be found on the total size of the Robo-Advisory market – except for the AUM of the top players in that sector. In Figure 3 (below), Morningstar illustrates the evolution of the top five Robo-Advisors from 2014 to 2017. The main takeaway here is that the two large traditional firms (i.e., Schwab and Vanguard) surpassed the three ‘pure’ Robo-Advisors in terms of AUM. Their combined AUM is estimated to have reached $155 billion – confirming previous observations that Robo-Advisors represent a small subsector of the overall wealth management industry. For comparison purposes, Capgemini’s World Wealth Report 2018 reported that the total HNWI financial wealth in North America reached $19.8 trillion at the end of 2017 (Capgemini).

Then again, Barbara Friedberg, in her article “6 of Newest Trends in Robo Advisors” published by U.S. News & World Report, on June 27th, 2018, reports that “the robo advisory market is expected to reach between $2.2 trillion to $ 3.7 Trillion in AUM by 2020 and $16 trillion by 2025.” In turn, Capgemini in its “Top Ten Trends in Wealth Management 2018,” corroborates that – at the global level – “automated advisors utilizing AI are expected to have assets worth $2.2 trillion by 2020.” (Capgemini) One could indeed argue that Robo-Advisory will continue to play an important role in the digitalization of wealth management services, because of these four key drivers:

- Ongoing demand from HNWIs for improved customer experience that comes with technology. With the smart phone or tablet becoming indispensable in our day-to-day lives, technology-driven solutions must remain in the forefront of any sustainable business proposition;

- Shifting demographics comprised of the X- and Y-Generations, which by nature are tech- savvy and used to having free access to information. “In the next few decades, it is estimated that over $30 trillion of wealth will transfer to the next generation in North America alone.” (World Economic Forum, 2019) Wealth managers and FAs should not ignore them;

- Ongoing regulatory scrutiny. Automation combined with Machine Learning can aid in mitigating operational- and reputational risks by promoting consistent asset allocation models and performance calculations, standardizing investment advice and suitability adherence, while fostering fee transparency among others;

- Ongoing cost pressures in running a profitable full-service wealth management firm and/or Hybrid Advisors (including RIAs).

Figure 3

Source: Morningstar (2018)

As far as fee structures charged for these services, according to Knowledge@Wharton, “fees can range from zero to as high as 0.89% of assets under $1 million” – depending on the complexity of the services requested. Otherwise, the fees are typically more like “0.25% to 0.30% of assets.” Fee compression is an ongoing phenomenon in the industry, which pushing many Robo- Advisors to form partnerships with traditional wealth managers or FAs (including RIAs) with the objective to generate additional revenue streams. Among Aite Group’s “Top Ten Trends” in 2019 the concept of “Home-office models” is introduced which basically means the outsourcing of investment management or portfolio construction to a third party by FAs who wish to dedicate their time to financial planning instead.

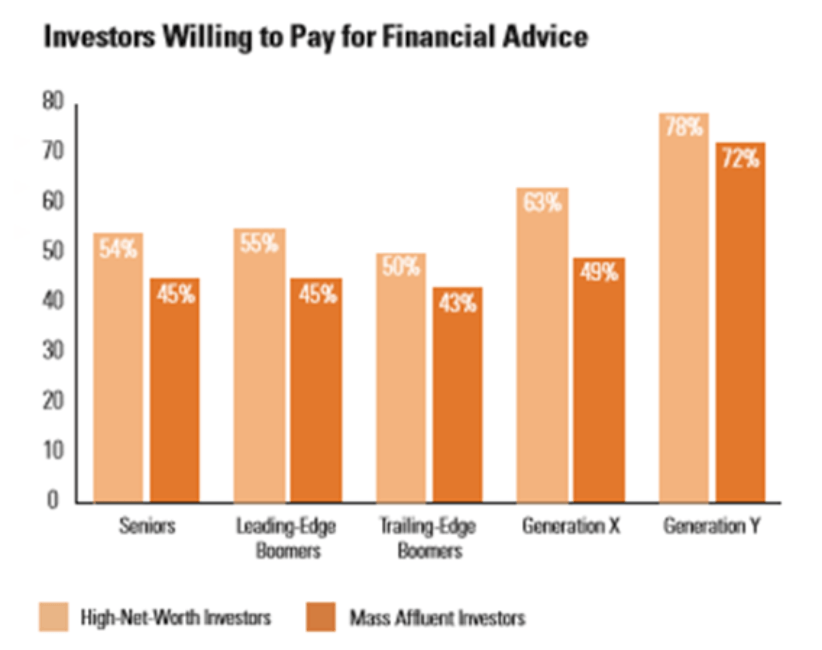

In a white paper published by Morningstar in 2015, Raef Lee of SEI Advisor Network observes that both Baby Boomers and Millennials are willing to pay a fee for financial advice. Figure 4 (below) further highlights that Generations X and Y are more disposed than their older counterparts in doing so (Morningstar, 2015). In January 2017, ThinkAdvisor corroborates the latter based on a study conducted by Cerulli Associates – a global asset management analytics firm – at which time it was found that “younger investors are the most willing to pay for advice, with 79% of households between 30 and 39, and 73% of households under 30, saying that they were willing to pay for advice.”

Figure 4

Source: Morningstar (2015)

Early last month, Barbara Friedberg published an update in U.S. News & World Report referring to the “5 Ways Robo Advisors Will Change in 2019.” In it, she brings forth that during 2019: FAs will get to show their added-value to the financial advice industry; there will be a rise in niche- players, such as providing Sharia-compliant investing; more banks and nonfinancial companies will be offering Robo-Advisory solutions; and, finally, there will be more Robo-Advisors specialized in Sustainability as a response to the increasing demand by the younger generation of investors (U.S. News & World Report, 2019).

Shortcomings of Robo-Advisors

Robo-Advisors are merely as good as those that created them. Moreover, algorithmic-driven Robo-Advisors have yet to be tested during a big market downturn, considering that they were introduced into the industry after the Financial Crisis of 2007-2008 (U.S. News & World Report, 2017). Human investors, on the other hand, are strongly influenced by life-events, such as marriage, divorce, illness, family disputes, business succession, or retirement. Cynthia Stephens of ByAllAccounts refers to these influences as “event-driven” investing where investors “are seeking something the robo-advisor sites can’t offer – namely, the wisdom and experience of a human advisor who personally knows the investor. They are looking for an advisor who can make an investment recommendation that transcends algorithm-based number crunching.” (Morningstar, 2015) Knowledge@Wharton further underscores the importance of the human touch during difficult cycles in financial markets – apparently supported by empirical evidence that investors with access to FAs become “less risk-averse and less likely to overreact to market downturns.” Last but not least, Robo-Advisors cannot educate clients about their investments nor intuitively assess the level of investment knowledge of an investor (Knowledge@Wharton). Optimal client fact- finding or profiling is an art that’s much better performed by a FA than a robot.

Opportunities for Financial Advisors and Robo-Advisors Alike: A Promising Conclusion

This article was written with the primary purpose to address those FAs that fear the entry of Robo-Advisors into the wealth management space. Albeit Robo-Advisors have only shown modest growth in asset size within the $70 trillion global wealth management market, they come with lots of buzz promoted by Silicon Valley inventors combined with media sensationalism around the subject of technological disruption in the industry. It is true that – at present time – the dominating influencers in wealth management are all related to technology in some form or another, alarming many traditional players on the potential eradication of investment advice and financial planning as we know it.

Then again, to stay aligned with the limited focus of this write-up, the title chosen for this article was meant to (hopefully) pass on the message to FAs that by embracing Robo-Advisory their longevity may remain viable. Humans and Robo-Advisors can coexist – by leveraging each other’s capabilities and competencies. John O’Connell of Macquarie describes it in a more relative manner: “In the near future, every human advisor could have the benefit of a deeply granular robo engine in their dashboard – much the same a GPS guidance system is today. This could be used in a hybrid approach, with the robo doing the ‘donkey’ work of the rigour analysis and the human adviser handling the ‘gamma’ of managing the client’s emotions and behavior biases around this – most likely over video phone chats” or face-to-face (Finextra, 2016).

All references consulted herewith, and studies discussed herein, point towards a promising symbiotic coexistence between Robo-Advisors and FAs. In other words, FAs concerned about their survival in this fast-changing sector should not hesitate in embracing technology.

From several interviews conducted by TheStreet in early 2017, FAs are recommended to “navigate toward areas that are less mathematical in their functions.” Regardless of the high-tech era we have entered, empathy and compassion will become fundamental traits to own – enabling FAs to meet customers’ expectation of being able to develop a more high-touch, personal relationship with their advisors (TheStreet; World Economic Forum). As alluded earlier on in the article, investors are event-driven and – consequently – they still look for FAs that “can make investment recommendations that transcend algorithm-based number crunching.” (Morningstar, 2015) With the $30 trillion of wealth transfer expected from Baby Boomers to Millennials in the next few decades, combined with the increasing interest in Hybrid Advisors, these two phenomena generate great opportunities for FAs to refocus their attention and start catering towards the younger generation. Forming partnerships or home-office models with Robo-Advisors (including niche or specialty players) could result in cost-effective delivery of asset management services which, in turn, would free up their time to focus on more complex financial- and intergenerational planning. Segmentation of one’s client base will become a critical exercise in support of how best the FAs should allocate their time, enabling them “to [further] demonstrate their value in the post- financial crisis and digital world where clients demand that their unique needs are met in real- time.” (Finextra, 2016)

Finally, when considering that a majority of investors continue to be either full- or partial- delegators of their investment decision process, combined with their willingness to pay a fee for financial advice, successful FAs should further sophisticate themselves in complex financial and estate planning (which would justify the charging of a fee). Pay attention to “investor priorities against the complexity of family histories;” offer financial guidance “through unexpected life events;” and, educate investors on risk-taking in the markets and its implications.

In other words, FAs should perfect their skills in client fact-finding or client profiling as it’s commonly referred to – enabling them not only to get to know their clients better but, to also facilitate their clients’ journey through the world of finances.

References

- 2019, https://aitegroup.com/report/top-10-trends-wealth-management-2019-revisiting-value-chain.

- BlackRock, “Digital Investment Advice: Robo Advisors Come of Age,” 2016 White Paper, https://www.blackrock.com/corporate/literature/whitepaper/viewpoint-digital-investment-advice-september-2016.pdf.

- Capco, “The Hybrid Advice Model: A European View,” 26 Nov, 2018, https://capco.com/Intelligence/Capco-Intelligence/The-Hybrid-Advice-Model-A-European-View.

- Capgemini, “Top-10 trends in Wealth Management: 2019,” 10 Dec, 2018, https://www.capgemini.com/resources/top-10-trends-in-wealth-management-2019/.

- Capgemini, “Top-10 trends in Wealth Management: 2018,” 7 Dec, 2017, https://www.capgemini.com/resources/top-10-trends-in-wealth-management-2018/

- Capgemini, “World Wealth Report 2018,” Pdf.

- CGI Group, “The Advisor’s Robo: Providing well-rounded financial advice and servicing through automated technologies,” 2017, https://www.cgi.com/sites/default/files/white-papers/hybrid-advisory-model-cgi-patpatia.pdf.

- Deloitte, “Emerging Models of Digital Wealth Advisory,” 10 Apr, 2017, https://www2.deloitte.com/lu/en/pages/financial-services/articles/emerging-models-digital-wealth-advisory.html.

- Equity Institutional, “Six Ways Financial Advisors can Benefit from the Coming Boom in Robo-Advice Assets,” 2016, https://www.equityinstitutional.com/EquityInstitutional/media/Documents/robo-advisor-whitepaper.pdf?pdf=Six-Ways-Whitepaper.

- Financial Engine, “Our History,” 2019, https://financialengines.com/about-us/history.

- Finextra, “The Future of Advisory: Exploring the Impact of Robo on Wealth Management,” 5 Sep, 2016, https://www.finextra.com/finextra-downloads/surveys/documents/e47ab3d0-30bc-4ea6-994f-c67f701da9c4/fin_wealth_epamv5_090516.pdf.

- com, “SEC charges robo-advisers with misleading clients,” 21 Dec, 2018, https://www.ft.com/content/43e52fa2-054c-11e9-99df-6183d3002ee1.

- Gary Karz, CFA, “Robo-Advisors : The Good, The Bad, and The Ugly,” 8 Oct, 2015, https://aaiisandiego.com/wp-content/uploads/2016/02/20151008_presentation.pdf.

- Journal of Financial Planning, “Hybrid Advice: Blurring the Roles of Client and Advise,” 2018, https://www.onefpa.org/journal/Pages/JAN18-Hybrid-Advice-Blurring-the-Roles-of-Client-and-Adviser.aspx.

- Knowledge@Wharton, “The Rise of the Robo-advisor: How Fintech Is Disrupting Retirement,” 14 Jun, 2018, http://knowledge.wharton.upenn.edu/article/rise-robo-advisor-fintech-disrupting-retirement/.

- Morningstar, “The Evolution of Robo-Advisors: An updated look at the landscape of automated wealth management,” Jul 11, 2018, https://www.morningstar.com/blog/2018/07/11/robo-advisors.html.

- Morningstar, “What You Can Learn From Robo-Advisors: 15 Qs and As on Adapting and Thriving in a Changing Industry,” 2015 White Paper, http://mscomm.morningstar.com/robowpcorp.

- SS&C Advent, “Robo-Advisors Client portals and the $30 trillion opportunity,” 2016 White Paper, http://cdn.advent.com/cms/pdfs/papers/WP_ROBOADV.pdf.

- TechBullion, “What is a Robo- Advisor, Origin and History?, 24 Nov, 2016, https://www.techbullion.com/robo-advisor-origin-history/.

- TheStreet, “What Will the Financial Advisor Industry Look Like in 2020?,” 21 Feb, 2017, https://www.thestreet.com/story/14007152/1/what-will-the-financial-advisor-industry-look-like-in-2020.html.

- ThinkAdvisor, “Investors Increasingly Willing to Pay for Financial Advice: Cerulli,” 5 Jan, 2017, https://www.thinkadvisor.com/2017/01/05/investors-increasingly-willing-to-pay-for-financia/.

- Thomson Reuters, “Will robos transform the wealth management industry?,” 9 Dec, 2015, https://blogs.thomsonreuters.com/answerson/automated-robo-advisor-wealth-management/.

- S. News & World Report, “5 Ways Robo Advisors Will Change in 2019,” 6 Feb, 2019, https://money.usnews.com/investing/investing-101/articles/how-robo-advisors-will-change.

- S. News & World Report, “6 of the Newest Trends in Robo Advisors,” 27 Jun, 2018, https://money.usnews.com/investing/investing-101/articles/2018-06-27/6-of-the-newest-trends-in-robo-advisors.

- S. News & World Report , “9 Things to Know About Robo Advisors,” 5 Oct, 2017, https://money.usnews.com/investing/investing-101/slideshows/9-things-to-know-about-robo-advisors.

- World Economic Forum, “Why wealth management needs more EQ than IQ,” 18 Jan, 2019, https://www.weforum.org/agenda/2019/01/why-the-human-factor-will-always-trump-ai-in-wealth-management.

About the Author: Maurella van der Ree

Maurella’s specific topics of expertise include:

- Strategy Execution

- Business Model Implementation

- Corporate Governance

- Policy & Procedures

- Regulatory Compliance/Global

- Conduct Risk & Ethics

- Investment Product Distribution

- Relationship Management

- Investment Consulting

- Research & Sensemaking