Comparing and Contrasting CCAR and DFAST

The Federal Reserve System’s (the Fed) regulatory responsibilities include the oversight of bank holding companies (BHCs), savings and loan holding companies, state member banks, and systemically important nonbank financial institutions (SIFIs). The Fed has reacted to some of the negative outcomes associated with the recent financial crisis by creating a new framework and programs for the supervision of the largest and most complex financial institutions. Among these is an annual assessment of whether BHCs with $50 billion or more in total consolidated assets have effective capital planning processes and adequate capital to absorb losses during stressful economic conditions. This annual assessment includes two related programs: (1) The Comprehensive Capital Analysis and Review (CCAR) and (2) Dodd-Frank Act Supervisory Stress Testing (DFAST).

Comprehensive Capital Analysis and Review (CCAR)

The CCAR evaluates a BHC’s capital adequacy, capital adequacy process, and its planned capital distributions (dividend payments and common stock repurchases, etc.). As part of CCAR, the Fed evaluates whether BHCs have sufficient capital to continue operations during times of economic and financial market stress and whether they have robust, forward-looking capital planning processes that account for their unique risks. The Fed may object to a BHC’s capital plan based on either quantitative or qualitative grounds. If the Fed objects to a BHC’s capital plan, the BHC may not make any capital distribution unless the Fed indicates in writing that it does not object to the distribution.

The Capital Plan Rule

The capital plan rule1specifies four mandatory elements of a capital plan:

- An assessment of the expected uses and sources of capital over the planning horizon that reflects the BHC’s size, complexity, risk profile, and scope of operations, assuming both expected and stressful conditions, including

- Estimates of projected revenues, losses, reserves, and pro forma capital levels and capital ratios (including the minimum regulatory capital ratios and the tier 1 common ratio) over the planning horizon under baseline conditions, supervisory stress scenarios, and at least one stress scenario developed by the BHC appropriate to its business model and portfolios;

- A discussion of how the company will maintain all minimum regulatory capital ratios and a pro forma tier 1 common ratio above 5 percent under expected conditions and the stressed scenarios;

- A discussion of the results of the stress tests required by law or regulation, and an explanation of how the capital plan takes these results into account; and

- A description of all planned capital actions over the planning horizon

- A detailed description of the BHC’s process for assessing capital adequacy;

- The BHC’s capital policy; and

- A discussion of any baseline changes to the BHC’s business plan that are likely to have a material impact on the BHC’s capital adequacy or liquidity.

Dodd-Frank Act Supervisory Stress Testing (DFAST)

The DFAST is a forward-looking quantitative evaluation of the impact of stressful economic and financial market conditions on the capital adequacy of the institutions subject to these requirements. This program serves to inform the Fed, the bank holding companies subject to this regulatory requirement, and the general public, how these institutions’ capital ratios might change during a hypothetical set of adverse economic conditions as designed by the Fed. In addition to the annual supervisory stress test conducted by the Fed, each BHC is required to conduct annual company-run stress tests under the same three supervisory scenarios and conduct a mid-cycle stress test under scenarios developed specifically by each BHC to reflect the intrinsic risks associated with that institution.

CCAR vs DFAST

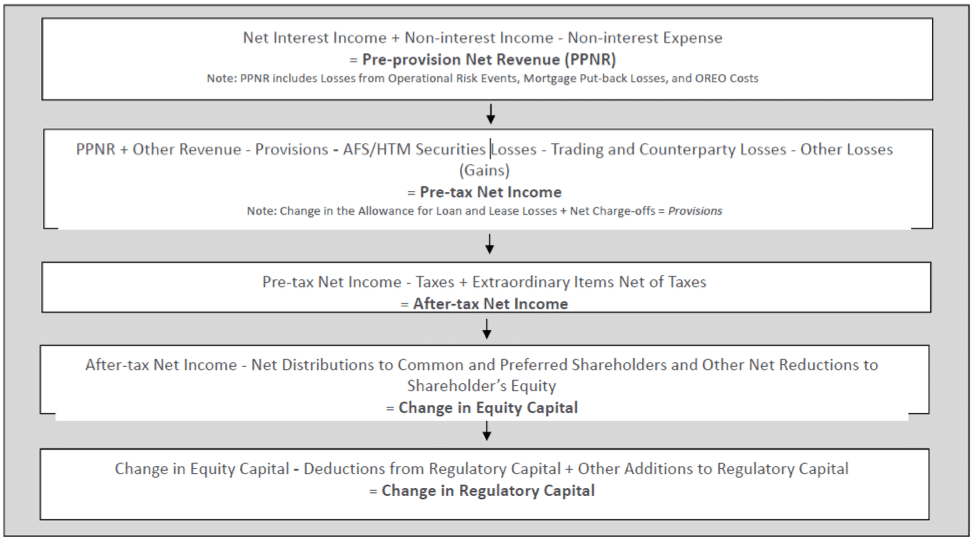

While DFAST is complementary to CCAR, both efforts are distinct testing exercises. Both rely on similar processes, data, supervisory exercises, and internal resource requirements. CCAR and DFAST processes include similar projections of pre-tax net income (called “Pre-Provision Net Revenue” or PPNR) which is then subject to stress testing, as illustrated in the following diagram2:

However, the capital action assumptions that are combined with these income projections to estimate a BHC’s post-stress capital levels and ratios can be different. For instance, under CCAR a BHC is allowed to include their planned capital actions in their calculation of post-stress capital levels and ratios. However, DFAST stress scenarios often assume that the BHC would not be able to either raise additional capital or would suspend dividends and any planned stock buy-backs.

Exemptions to CCAR and DFAST

The Fed coordinates these processes to reduce duplicative requirements and to minimize regulatory burden. The requirements, expectations, and activities relating to DFAST and CCAR do notapply to any banking organizations with assets of $10 billion or less. However, that does not suggest that smaller institutions do not need to conduct some type of stress testing. The Fed, the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corp. (FDIC) each emphasize that all banking organizations, regardless of size, should have the capacity to analyze the potential impact of adverse outcomes on their financial condition.

2015 CCAR and DFAST Results

Results of the 2015 CCAR exercise can be found at the following link:

Results of the 2015 DFAST exercise can be found at the following link:

http://www.federalreserve.gov/bankinforeg/stress-tests/2015-Executive-Summary.htm

References

1Board of Governors of the Federal Reserve System: Comprehensive Capital Analysis and Review 2015: Assessment Framework and Results (March 2015)

2Source: Beverly Hirtle – Research and Statistics, Federal Reserve Bank of New York

About the author

He is also the President and CEO of Strategic Financial Solutions, Inc., a financial services consultancy specializing in risk management consulting and training for institutions managing market, credit, operational, and other risks. He is a consultant and instructor for the Investment Training and Consulting Institute, Inc. and a Certified Investments and Derivatives Auditor (CIDA). He is also an instructor for many other organizations and industry groups including the FFIEC, the Federal Reserve System, the FDIC, the BAI, the IIA, and the Global Financial Markets Institute.

Rob started his career in 1986 with the Federal Reserve System as an economist in the Research Division and later became a commercial banking and capital markets specialist in Bank Supervision and Regulation. Over his 12 years there, he analyzed the strategies and exposures of on- and off-balance sheet positions, investments, and trading activities of banks, and assessed the adequacy and effectiveness of risk management and recommended strategies to senior management to improve risk monitoring, increase profitability and to reduce the likelihood of failure. Rob chaired a system-wide committee to design, develop and deliver capital markets training to examiners as well as domestic and international financial institutions.

From 1998 to 2000, Rob was a Senior Manager in the Financial Services Industry Group for Accenture, Ltd. where he headed a joint task force responsible for defining and implementing a post-merger organizational structure for First Union’s Brokerage Division’s IT department.

Rob, a charter holder of the Bank Administration Institute’s Certified Risk Professional (CRP) designation and ITCI Certified Investments and Derivatives Auditor (CIDA), has delivered capital markets and risk management seminars to financial institutions across the U.S. as well as in numerous countries in LATAM, Asia Pacific, and Europe.

Copyright © 2015 by Global Financial Markets Institute, Inc.

Download article