Central counterparty clearing houses, or more simply central counterparties (“CCPs”), have emerged from the 2008 financial crisis as lynchpins of the global derivatives markets, and therefore, a critical part of the infrastructure of the global financial system. This article addresses the following questions:

- What are CCPs, and what role do they play?

- What is a CCP “member”?

- What risks do CCPs face?

- How do they manage and mitigate those risks?

- How does one CCP differ from another?

What Are CCPs?

A central counterparty (“CCP”) is a financial institution defined by the Bank for International Settlements (“BIS”) as, “a clearing house that interposes itself between counterparties to contracts traded in one or more financial markets, becoming the buyer to every seller and the seller to every buyer and thereby ensuring the future performance of open contracts.” [1]A CCP is also known in the US as a Derivatives Clearing Organization (“DCO”), and is regulated as such by the Commodity Futures Trading Commission (“CFTC”). 2

What are CCP Members?

CCP members are financial institutions that wish to clear trades through a central counterparty in order to eliminate the counterparty credit risk arising from their trade with a bilateral counterparty. Prospective CCP members apply for membership in CCPs that clear the types of instruments the prospective member trades. For instance, a bank that trades credit default swaps (CDS) would consider becoming a member of ICE Clear Credit, a leading clearer for CDS. For its part, the CCP desires members who will generate volume, who meet credit standards set by the CCP, who run efficient and compatible trading systems, and are willing to meet other obligations to the CCP, such as contributions to the default fund (more later). The credit worthiness of members is important because a member needs to be able to put up collateral for its trades, and must be able to support the CCP in times of stress. Specific obligations of membership will be set by each CCP, may vary from one CCP to the next, and may remain relatively undisclosed to the general public.

Risks CCPs Face

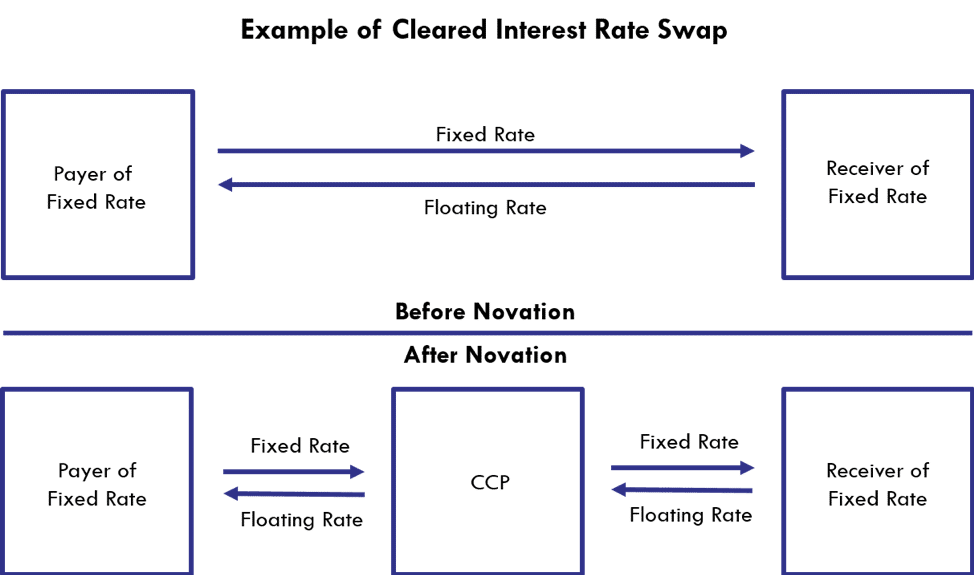

To minimize risk to both counterparties, the CCP enters into two contracts: one with Party A (e.g. the seller); and one with Party B (e.g. the buyer), which replace the “pre-clearing” direct agreement between buyer and seller. Legally this is referred to as “novation. From the moment of novation, both the buyer and the seller look to the CCP alone for future performance under the contract.

A typical example for an interest rate swap is depicted in the following diagram:

Managing and Mitigating CCP Risks

By standing in the middle of the above trade, the CCP assumes the counterparty credit risk of each side of the trade: of the Payer of Fixed as well as the Receiver of Fixed. If at any time during the life of the contract, one of those two parties defaults, and there is a cost to replace that defaulted counterparty in the then current market, then the CCP must pay that replacement cost. Of course, margin is required from the two counterparties, and will normally offset this replacement cost to the CCP, but more on this in a moment.

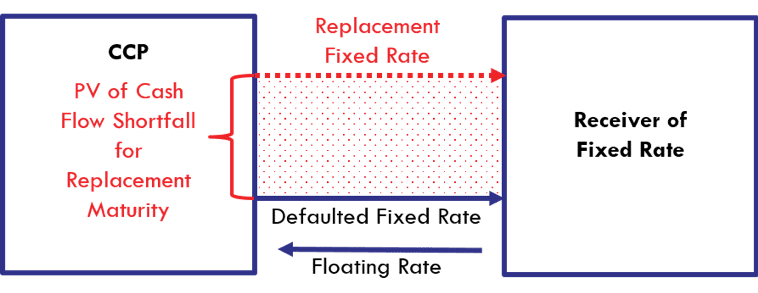

For instance, assume the original maturity of the swap was 5 years, and 2 years have gone by since the initial swap was transacted. Further assume, the Receiver of Fixed defaults at the end of this 2-year time period, and that the swap rate prevailing for the remaining 3-year maturity of the contract is higher than the contractual fixed rate on the original defaulted swap. In theory, a replacement swap at the then current market would be executed by the CCP, and the present value of the difference between the defaulted cash flows of the contractual swap rate, and market rate cash flows of the replacement swap rate, would be the replacement cost of the swap. The Federal Reserve suggested that it may begin raising interest rates by the end of 2015, so this type of exposure is likely for a CCP clearing an interest rate swap transaction at the time of this article, September, 2015. The following diagram depicts the difference in cash flows at default used in calculating the replacement cost, and thereby suggests how a rise in the replacement fixed rate would increase the amount of collateral required by the CCP if the Receiver of Fixed were to default.

As we previously mentioned, the CCP protects itself by requiring every counterparty (including the original Payer and Receiver of Fixed) to post collateral, commonly referred to as margin, in an amount sufficient to cover both (a) the cost of replacing a defaulted swap in the then-current market, and (b) an amount estimated by the CCP to cover any movement in replacement cost from the time of last collateral calculation and posting, to the point at which a replacement transaction is completed.

Measuring and managing the amount of collateral required to protect the CCP against a member default is the first, and by far the most important, defense that the CCP has against the cost of a counterparty default. But that is not a trivial task. The actual replacement cost will vary from moment to moment with movements in the marketplace. Furthermore, marketplace movements can be large and unexpected, and it is possible that in the wake of such an unanticipated market move, the replacement cost will exceed the last collateral from the defaulted party.

Therefore, the CCP must estimate how much the market can move in order to have sufficient collateral on hand to pay for the replacement transaction, even in turbulent and less liquid market conditions. Each CCP does this by creating its own collateral/margin model for different types of derivative transactions, and for instruments within a particular derivative asset class that may have more (or less) price volatility. If, at the time a member defaults, its posted collateral were insufficient to pay for the replacement transaction, the CCP would have to provide available funds to make up the shortfall.

The market for credit default swaps (CDS) is one market with particular risk — as transactions involving a declining credit may be prone to “jump to default” should an adverse credit event suddenly occur. Such adverse events could be a function of individual credits, entire sectors e.g. housing, or the credit cycle in general — all of which can cause significant changes in valuation of a particular transaction, or across the entire CDS portfolio of specific clearing members. Therefore, a CCP for CDS would require greater margin from its members, than a CCP for interest rate swaps with equivalent volumes.

It is worth remembering that any active member of the CCP would have a large portfolio of different transactions outstanding, and therefore the aggregate size of the CCP’s exposure to the default of any single member is almost certainly to be a much larger number than the exposure under a single transaction, especially since many transactions may be in the range of several hundred million dollars e.g. an interest rate swap on a large leveraged loan. Although netting of transactions for a large market maker will no doubt reduce the aggregate net risk through the offsetting of exposures, there will also be instances in which large counterparties (or even entire market segments) are trading in the same direction, so that incremental volume adds to aggregate CCP exposure, rather than offsets it.

A good example of this in the market just before August 2015, would be bond investors seeking to hedge against rising interest rates by swapping fixed rate bonds into synthetic floating rate assets. As a group they were collectively paying fixed more often than not, and thereby exposing the CCP to growing default risk if rates were to fall unexpectedly. Although the markets anticipated a rise in rates with an improving economy, the late August 2015 steep decline in global stock markets prompted many investors to buy US Treasuries in a “flight to safety”, thereby causing Treasury yields to fall unexpectedly.

CCP Defensive Strategies

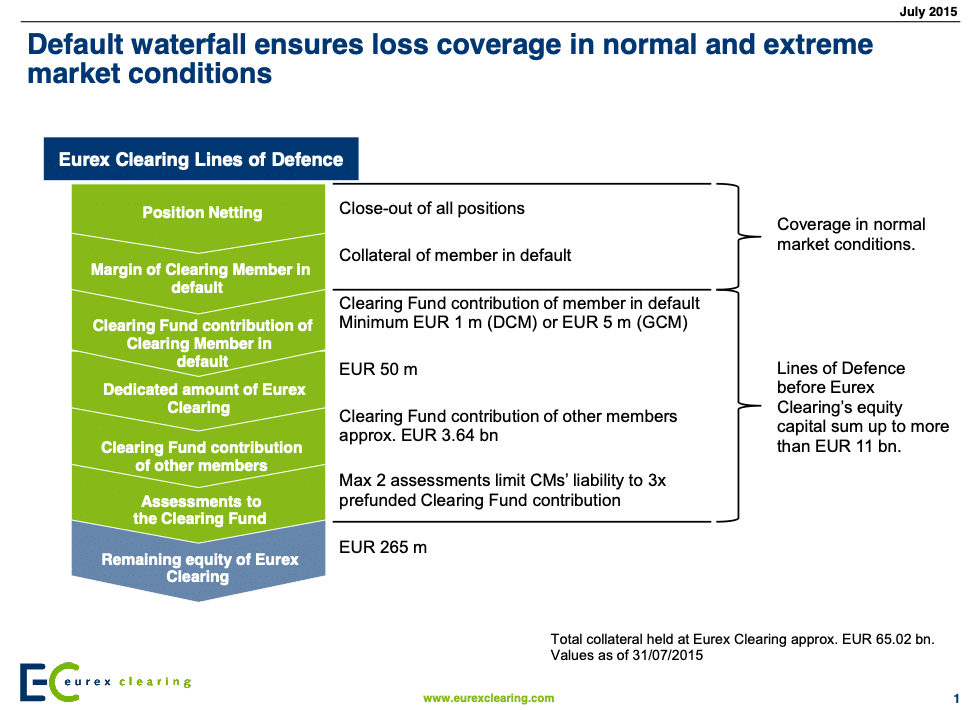

Since margin, alone, might be insufficient to protect the CCP from a counterparty default, CCPs adopt a number of other defenses to protect themselves against member defaults. These consist of a number of different layers of backup liquidity that are available for use by the CCP in a predefined sequence, after a defaulting member’s collateral has been exhausted. These typically consist of the following, and are often referred to as the CCP’s “waterfall”, a term reminiscent of the cash flow “waterfall” in MBS and other structured debt instruments:

- A “default fund” created by the CCP from its own resources;

- A “general default fund” created by contributions from all members of the CCP, but available to provide liquidity to the CCP should any members default;

- Incremental assessments made to all CCP members;

- A guarantee from the parent company of the CCP (many CCPs are owned by an exchange, or part of a larger corporate group); and

- Capital of the CCP.

The precise sequence, as well as terms and conditions upon which each of these resources can be accessed, will be defined specifically by each CCP as part of its terms of membership, which in turn will largely depend upon its overall business strategy and the derivative products it chooses to clear.

The following diagram, from Eurex Clearing, provides a good illustration of a defensive waterfall for a CCP, and also differentiates the market conditions under which it might be expected to access different layers of the waterfall.

- Normal market conditions, where a clearing member defaults as a result of its own poor decisions, e.g.

- Lehman, which was highly leveraged and holding large volumes of toxic structured securities, such as CDOs, that collapsed in value, and

- MF Global, which purchased a substantial amount of emerging market debt that also collapsed in value.

- In normal market conditions, the defaulting member’s own collateral and contributions to the default fund would be expected to be sufficient to protect the CCP, and in fact were so in the case of Eurex.

- Extreme market conditions, where a clearing member defaults, not because of its own poor decisions, but because of extreme (not “normal”) overall market conditions. In this case, contributions and resources of all members would be called upon to support the CCP if the defaulting member’s own collateral and contributions together were insufficient.

Source: Eurex Clearing website accessed September 2015

The above illustration also provides specific amounts in each layer of the waterfall, thereby assisting potential investors or clearing members to evaluate the safety of the CCP.

Subject to regulatory constraints, CCPs can decide how much or how little information to disclose, and will usually decline to disclose details of elements important to its competitiveness, such as the exact models used for determination of margin requirements.

CCP Operational Risks

One can scarcely overestimate the amount of operational risk borne by a CCP. Firstly, the CCP is entrusted with being able to cover the counterparty credit exposure in derivatives for all of its members, so that its reputational risk is immense. Regulators have expressed a distinct position that CCP’s should be sufficiently strong to not require any government bailout; but given the central functions performed by such CCPs across broad swaths of the financial markets, the government might well rescue a vital CCP if all private alternatives fail. This establishes a high standard of maintaining confidence by avoiding even close calls.

Some (not all) critical operational tasks would include:

- Onboarding, novating and settling voluminous complicated derivatives trades for all its members on a near real time basis;

- Reporting such trades to swap data repositories;

- Maintaining accurate netting sets for all transactions;

- Developing, maintaining and updating margin models for all transactions, different structures, indices, and derivative asset classes;

- Managing and maintaining all layers of the defensive waterfall;

- Stress testing all aspects of the business;

- Maintaining cybersecurity;

- Maintaining effective business continuity plans, including conducting cross industry collaborative drills.

All of the risks and mitigants discussed so far in this article could be considered as general default management capabilities, covering how the CCP manages counterparty credit risk, extreme market conditions, risks inherent in different derivative products, and waterfall defenses.

CCPs are Businesses

Finally, it is important to note that CCPs are usually business entities, part of a larger group, expected to be profitable, and generate sufficient cash to meet financial obligations in addition to their core function of reducing counterparty credit risk. Each CCP has its own business strategy, typically related to a parent exchange, and a competitive advantage in certain derivative asset classes. These differences in strategy and focus naturally will lead to distinctions in risk concentrations, in the type of member the CCP attracts and desires, the expectations of the CCP for member involvement in times of stress, the construction of its waterfall defenses, and compliance and regulatory functions.

An illustrative example of how these differences can manifest themselves is in the recent “basis” difference between interest rate swap trades cleared by LCH.Clearnet vs. CME Group, referred to in the market as the CME-LCH Basis Spread. Although a swap cleared on either CCP is economically the same, the difference quoted in the broker market was as high as 2 basis points (www.clarusft.com/cme-lch-basis-spreads), a not insignificant figure in the interest rate swap market.

In summary, as the importance of CCPs continues to grow, and both competitive pressures and regulatory scrutiny follow suit, it is my expectation that CCPs will become increasingly sophisticated, efficient, complex and differentiated. Hopefully, transparency for regulators and investors, and strong infrastructure will grow commensurately.

About the Author

Charles began his career as a multinational lending officer for Citibank, after which he became a founder of Citi’s derivatives business. He completed many “first time” derivatives transactions for Citi, including its first interest rate swap in the United States, and helped the World Bank develop its swap program. Subsequently, he was global head and a founder of First Chicago’s currency swap business, SG Warburg’s international private placement and gold advisory, and Rabobank’s credit derivatives business, completing over $12 billion in credit derivative transactions. Charles served as Co-Head of the Credit Risk Management practice of Deloitte & Touche, a Senior Vice President of FRM (a premier global fund of hedge funds now part of Man Group), and a Managing Director of Grammer and Co. He has completed multiple expert witness assignments.

Charles has been a talent development professional throughout his career, covering topics such as credit analysis, process and presentation skills, capital markets and derivatives across the major asset classes of interest rates, foreign exchange, equities, commodities, hedge funds and credit (credit derivatives). He has taught client relationship building and marketing, leadership development, and is an executive coach, and a career coach at Columbia Business School.

He wrote “Building the Organization to Support the 130/30 Opportunity” for the prime brokerage consultancy of a major US investment bank, published in the Journal of Investing, and has been featured in Euromoneymagazine.

Charles is a member of GARP, FIASI, and ATD. He holds an MBA, cum laude, from Columbia Business School, and a BA, cum laude, from Yale.

Copyright © 2015 by Global Financial Markets Institute, Inc.

[1]www.bis.orgCapital requirements for bank exposures to central counterparties, July 2012, Annex 4, Section I, A. General Terms

2cftc.gov accessed September 2015

Download article